International investment return comparison: Difficult investment year caused billions in loss from investments

Most pension investors struggled last year, particularly in the last quarter of the year. The Norwegian Government Pension Fund Global (SPU) suffered the most from the slump in stock prices, losing as much as 6 per cent of its assets. Yet the return of nearly all of the actors included in the comparison improved over the 10-year review period.

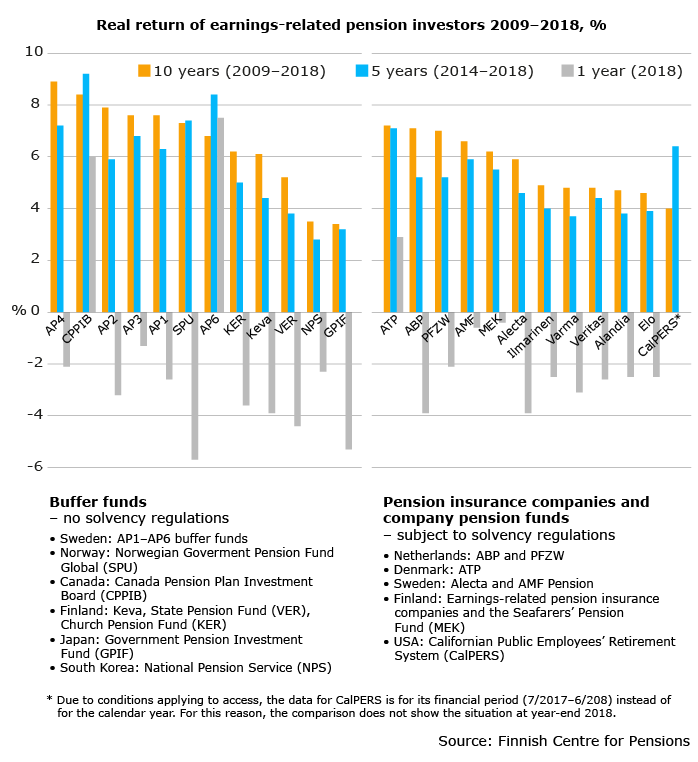

The international investment return comparison carried out by the Finnish Centre for Pensions includes a total of 24 earnings-related pension investors. The comparison covers the major Finnish earnings-related pension providers, as well as large investors from northern Europe and North America.

Two actors have been added to the comparison since last year. With the statutory pension funds of Japan (GPIF) and South Korea (NPS) included, the comparison now includes three of the largest pension investors in the world.

Japan is the largest pension investor (with €1,200 bn in pension assets), followed by Norway (€830 bn) and South Korea (€500 bn).

“Our comparison now includes seven of the ten largest pension investors. We have also extended the geographical scope of the comparison. It is interesting to compare how these two rapidly ageing nations prepare themselves for the change in demography via their investment operations,” says liaison manager Mika Vidlund (Finnish Centre for Pensions).

The earnings-related pension investors have been divided into two groups based on their risk bearing capacity: those that are bound by sustainability regulations and those that are not. The real returns were reviewed over a one-year, a five-year and a ten-year period between the years 2009 and 2018.

Weaker krone softened Norway’s loss from investments

The year 2018 was difficult for most earnings-related pension investors. As the appreciation of listed shares plunged in the last quarter of the year, the investment returns ended up in the red.

SPU in Norway suffered the greatest loss, nearly six per cent real term.

“The result is dramatic when compared to the fund’s top return last year (11.8%). The loss would have been even greater if the krone had not weakened,” explains senior adviser Antti Mielonen (Finnish Centre for Pensions).

The Canada Pension Plan Investment Board (CCPIB), the Swedish buffer fund (AP6) and the largest Danish earnings-related pension fund (ATP) stand out with their positive return of 3-7 per cent.

AP6 and CCPIB, with the highest returns in the year of comparison, profited from their capital investments. CCPIB’s result was also improved by the weakening Canadian dollar. ATP’s fixed-income security weighted investment portfolio also yielded a good return.

The average return of the Finnish earnings-related pension providers was slightly less than 3 per cent in the red, or on an average level in the comparison.

Investment returns improved over a ten-year period

Although pension investors struggled in 2018, the investment return of nearly all actors improved in the ten-year review period. The rise in return is explained by the financial crisis of 2008 dropping out of the review period.

The highest real return in the 10-year review period was shown by the largest Swedish buffer fund AP4 (8.9%) and the Canadian CPPIB (8.4%).

The average annual return of the Finnish pension investors was 5-6 per cent. The investment return of Finnish buffer funds (Keva, VER, KER) was approximately one percentage point higher than of those who are bound by sustainability regulations (earnings-related pension insurance companies and employment pension funds) over the last decade.

“The favourable development of the stock markets have kept the returns of most actors on a high level. The trade war between China and the US, as well as Brexit, cause uncertainty when looking into the future. It showed already in the last quarter of 2018,” Vidlund explains.

Earnings-related pension investors operate in different environments

It is not possible to draw direct conclusions on the success of investment operations based on this comparison. The final results are affected by, among other things, the currency region, exchange rates and investment regulations of the actors.

Preconditions of the investment return comparison

- The starting year and length of the period of comparison affect the results

- Yearly returns fluctuate greatly

- Long-term average returns depend on the selected period

- Currency region and fluctuations in exchange rates generate different results

- Return expressed in national currency (that is, in the same currency as the pension are paid)

- Real return is more suitable for comparison when inflation is excluded

- The solvency regulations and other regulations limiting the risks of investments set conditions for the investment operations

Read more

Investment operations of the earnings-related pension scheme (etk.fi)

More information

Mika Vidlund, Liaison Manager, Finnish Centre for Pensions, phone +358 29 411 2614, mika.vidlund(at)etk.fi

Antti Mielonen, Senior Advisor, Finnish Centre for Pensions, phone +358 29 411 2472, antti.mielonen(at)etk.fi