Pension Income Level

The earnings-related, national and guarantee pensions secure income in old-age, in case of disability and if the family’s breadwinner dies. In addition, pensions are paid from statutory motor liability insurance and workers’ compensation insurance. The overall pension security may also include private pensions or supplementary pensions paid by the employer. Statutory pensions are taxable income.

Earnings-related pension based on earnings

The purpose of earnings-related pensions is to ensure that the level of income enjoyed during working life continues at a reasonable level at the time of and throughout retirement.

Since the pension reform in 2017, all employment insured under the earnings-related pension acts accrues pension after the age of 17 (after the pension reform in 2005, pension accrued as of age 18). As a result, the earnings-related pension is the main source of retirement income of a person with an average working life.

National pension supplements the pension of low-income retirees

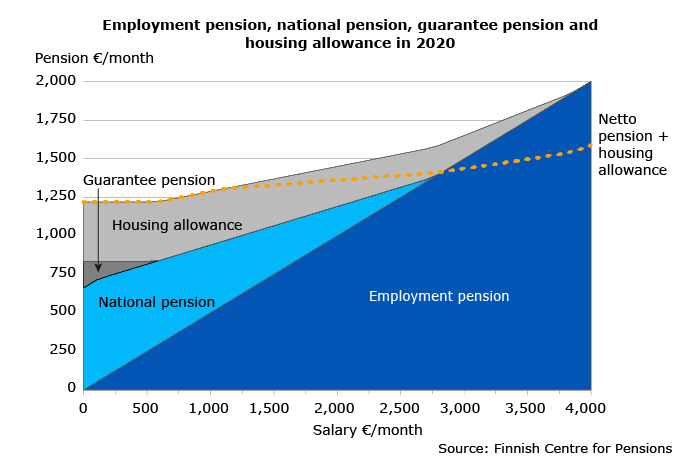

If the earnings-related pension is low due to a brief or split working life, the national pension improves the retirement income. Under certain conditions, all persons living in Finland have a right to get a national pension.

The income of low-income pensioners is further improved by other benefits paid by the Social Insurance Institution of Finland (Kela). The benefits include, among others, the housing allowance and care allowance for retirees. The guarantee pension that came into force in 2011 offers a minimum income for low-income retirees.

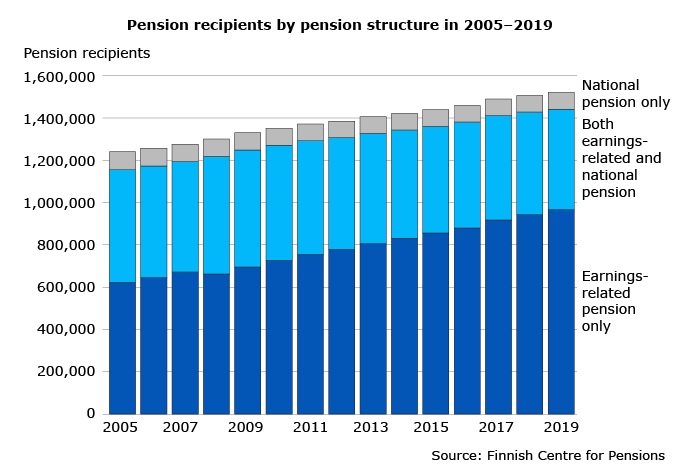

Nearly all retirees get an earnings-related pension

The earnings-related pension scheme forms a considerable part of pension provision in Finland. At the end of 2019, a total of 64 per cent of all retirees living in Finland who get a pension (excluding the survivors’ pension) got only an earnings-related pension.

Of all retirees living in Finland, about 31 per cent got a pension from both the earnings-related and the national pension schemes, while roughly 5 per cent get only a national pension. At the end of 2019, about 1,521,000 persons living in Finland got a pension in their own right. The total number of retirees (including those who get a survivors’ pension) was 1,612,000.

Voluntary supplementary pensions complement the retirement income

Occupational pensions paid for by employers or privately funded supplementary pensions supplement income during retirement. So far, supplementary pensions have played a minor role in Finland. Statutory pensions cover 94 per cent of the total pension provision.

Taxation determines the final level

The final pension level consists of the pension in hand after taxation and social security contributions. The taxation of statutory pensions is determined basically in the same way as the taxation of earnings from work, but the tax and contribution burden of pension income and earnings from work differ due to various tax deductions and social insurance contributions.

Different ways of measuring a retiree’s income level

The pension provision level can be measured by, for example, reviewing average pensions. The level of average pensions has increased because

- the earnings-related pension system has matured,

- wages have grown, and

- working lives have extended.

The level of pensions can also be reviewed by relating the pension to the earned income before retirement. This is known as the replacement ratio.

When the perspective is expanded from the pension level to the retiree’s income level, the size and structure of the household and the form of living make a difference. Two retirees living together get along with less money than do two retirees who live alone. It is also less expensive to live in an occupier-owned home than in a comparable rented home.

Read more