Earnings-related Pension Recipients in Finland

This statistics provides an overview of the Finnish earnings-related pension system. The statistics includes the key figures for all new retirees and retired persons on an earnings-related pension in Finland.

The statistics is released once a month. Year-level data is released three times a year. Check the Release Calendar for more detailed information on the release time.

Kk-tilaston vanha haitari

Älä poista tätä:

Monthly statistics

The Monthly statistics includes the most recent data on Finnish earnings-related pension recipients. The statistics include data on a monthly level of pension recipients, average pensions, pension expenditure and new retirees in the earnings-related pension system.

Statistical graphs

Check the monthly statistical data of earnings-related pension recipients in the graph applications.

- Earnings-related pension recipients

- New retirees on an earnings-related pension

- Earnings-related pension expenditure

Statistical tables

Earnings-related pension recipients:

- Number of earnings-related pension recipients

- Average earnings-related pension

- Monthly earnings-related pension expenditure

New retirees on earnings-related pensions:

- Number of new retirees on an earnings-related pension

- New retirees’ average earnings-related pension

Tables in database:

As of the beginning of 2021, survivors’ pensions that amount to 0 euro are no longer included in the statistics. This change affects the number of recipients of survivors’ pensions and the average pension level.

The amount of the paid survivors’ pensions is affected by the surviving spouse’s own earnings-related pension (or calculated accrued pension) and benefits paid based on motor liability and accident insurance. Taking them into consideration can lead to a survivors’ pension of 0 euro.

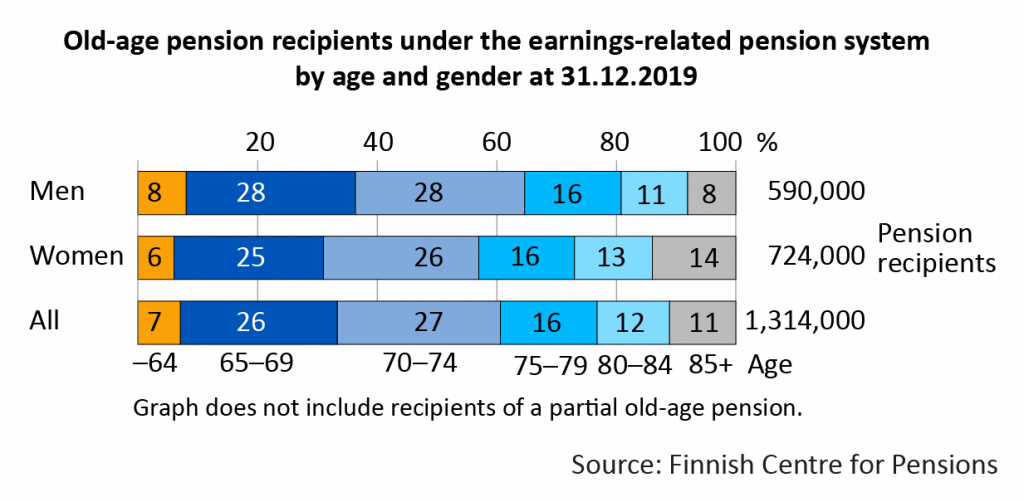

Around 60 per cent of old-age pensioners aged under 75

The number of old-age pensioners under the earnings-related pension system at year-end 2019 stood at 1,314,000, of whom 590,000 were men and 724,000 women. These figures do not include recipients of a partial old-age pension.

The average age of old-age pensioners was 74.5 years, for men 73.6 years and for women 75.2 years.

Seven per cent of all old-age pensioners were aged under 65. Around 60 per cent were aged under 75. The majority of old-age pension recipients were thus relatively young. Among men the proportion of those under 75 was 64% and among women 57%.

Around one in ten (11%) old-age pensioners were over 85. This figure was higher for women (14%) than for men (8%).

Read more:

- Number of new old-age retirees falls again

- Publication Earnings-related pension recipients in Finland (in Julkari)

Tables in statistical database:

- Number of earnings-related pension recipients

- Number of new retirees on earnings-related pension

- Size of earnings-related pension recipients’ pension

- Size of pension of new retirees on earnings-related pension

- Recipients of earnings-related pension living abroad

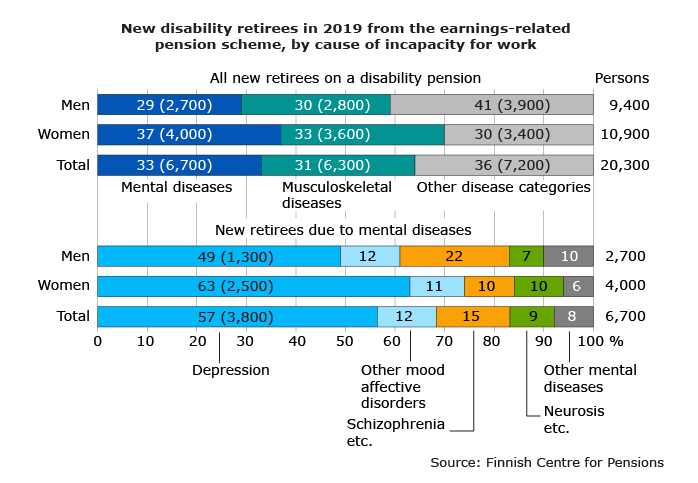

Mental disorders the most common reason for retirement on a disability pension

In 2019, around 20,300 persons retired on an earnings-related disability pension, slightly more than in 2018 (19,900). Of the new retirees, 10,900 were women (54%) and 9,400 men (46%).

The most common reason for retirement on a disability pension was mental and behavioural disorders (33% or 6,700 persons). The second most common cause were musculoskeletal diseases (31% or 6,300 persons). All other main disease categories counted for less than 10 per cent each.

Statistics on new retirees on a disability pension from the earnings-related pension system has been collected since 1996. In 2019, for the first time, mental disorders were the main reason for retirement on a disability pension. In previous years, musculoskeletal diseases were the main cause for retirement on a disability pension.

Of those retiring on a disability pension due to mental disorders, nearly three fifths (57% or 3,800 persons) were diagnosed with depression. Depression was clearly more common among women (2,500) than men (1,300). Of all mental disorders leading to retirement on a disability pension, depression was the cause for retirement for 63 per cent of the women and 49 per cent of the men.

At year-end 2019, a total of 134,000 persons were drawing an earnings-related disability pension. This was nearly 5,000 less than in 2018. Although mental and behavioural disorders passed musculoskeletal diseases as the most common cause for disability among new retirees on a disability pension only last year, it has been the most common cause for disability for a long time when looking at all retirees on a disability pension. This is because those who retire because of mental disorders tend to be younger than average, which means that they spend more time in retirement. In 2019, a total of 58,000 persons (43%) were drawing a disability pension because of mental disorders and 33,000 persons (25%) because of musculoskeletal diseases.

Read more:

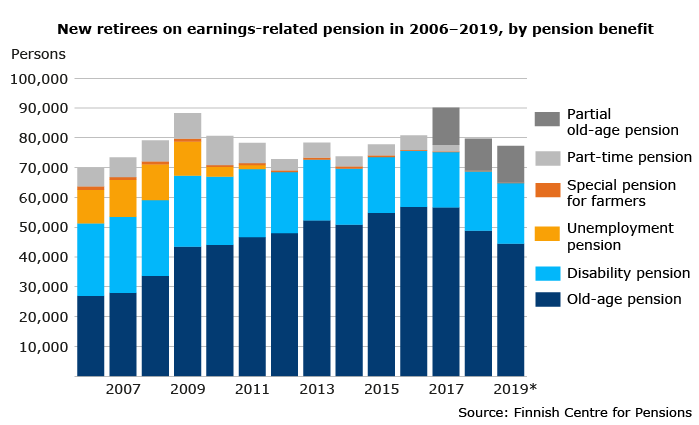

65,000 new retirees on an earnings-related pension

In 2019, a total of 65,000 people retired on an earnings-related pension in Finland. Most of them (44,500) retired on an old-age pension. The number of new old-age pensioners decreased by 9% from the previous year.

20,300 people took up disability pension, which was 400 more than in 2018. 200 people retired on a special pension for farmers.

A total of 12,300 people selected a partial old-age pension. Those who have taken a partial old-age pension are not considered to have retired in the statistics of the Finnish Centre for Pensions.

The most common age to retire is 63 years. In 2019, a total of 22,300 people retired at the age of 63.

Read more:

Statistical services provides further information:

Earnings-related pension recipients in Finland

Producer: Finnish Centre for Pensions

Website: Earnings-related pension recipients

Subject area: Social security

Part of the Official Statistics of Finland (OSF): Yes

Description

The statistics offers a general overview of all earnings-related pension recipients in Finland.

Data content

The statistics includes central data on all earnings-related pension recipients, new retirees on an earnings-related pension and the earnings-related pension expenditure in Finland.

Categorizations

private and public sector, pension benefit, gender and age, pension amount, disease classification ICD-10; regional classification: municipality, province, country of residence

Methods of data collection and source

The data on earnings-related pension recipients, new retirees and earnings-related pension expenditure are based on the pension register.

The regional data presented in the statistics are based on the population data of the Social Insurance Institution of Finland, supplemented with data on earnings-related pensions taxable at source and paid abroad, as reported by the pension providers.

Update frequency

The more restricted statistics Earnings-related Pension Recipients in Finland is released once a month. The more comprehensive statistics Pensioners in Finland is released once a year.

Time of completion or release

The monthly statistics is released by the middle of the following month and the annual statistics in the autumn of the year following the statistical year. For a more detailed schedule, consult the Release Calendar.

Time series

The statistics has been produced since 1996. In 2005-2013, the statistics was published under the name Pensioners and Insured in Finland.

The Quality Description of the statistics (section “Coherence and comparability of data”) includes more detailed information on the comparability of the time series.

Key words

Social insurance, pension, earnings-related pension, old-age pension, disability pension, disability pension, unemployment pension, farmers’ special pension, part-time pension, partial old-age pension, retirement

Concepts and definitions

Age

In the tables on persons having retired on an earnings-related pension, the age used is the age at the start of the pension. In other tables it is the age at the end of the statistical year.

The average age is the arithmetic mean of the ages. For recipients of an earnings-related pension the age is calculated from the age at the end of the statistical year, and for persons who have retired on an earnings-related pension, from the age when the pension starts.

The median age is the age for the middle-most observation in the data.

Domicile, country of residence, county

The domicile of a person is seen to be the domicile on the last day of the year. For pensions paid abroad, the country of residence is the country of residence on the last day of the statistical year.

Countries of residence are categorized according to the country categorization valid at the end of the statistical year. Counties are classified according to the regional classification in force at the end of the statistical year.

Earnings-related pension expenditure

Earnings-related pension expenditure includes all statutory pensions from the private and public sector paid during the statistical year, as well as voluntary, registered supplementary pensions paid by the employer, but not pensions paid by the municipalities according to the old local government regulations.

Main cause of incapacity

By main cause of incapacity to work is meant the main disease which is the basis of the pension. Although the reason for the disability may sometimes be a significant secondary disease in addition to the main disease, statistics are based solely on the classification of main diseases.

Since 1996, the diagnoses and the corresponding codes are based on the ICD 10 classification of diseases. Disability pensions granted before 1996 are based on the previous ICD 9 classification. The classification is primarily carried out according to the new classification of diseases. The codes according to the old classification have been as closely as possible placed in the correct category in the new classification (see Appendix 1).

New retiree on an earnings-related pension

New retirees receiving a pension based on their own work history are persons whose pension based on their own working career (old-age, disability or special farmer’s pension) has begun during the statistical year. A further requirement is that the new retiree has not received any pension of the aforementioned types for at least two years.

A scheme-based review is always carried out for the scheme in question. If a person has retired from another sector already prior to the statistical year, and is retiring from another sector during the statistical year, he or she is only registered in the latter sector for the statistical year, no longer in the figure of all who have retired. In other words, a person is only entered in figures relating to the whole earnings-related pension scheme in the statistical year during which the first pension begins. The scheme-specific figures of the tables can thus not be added together.

Persons having retired on an old-age pension are persons whose old-age pension started in the statistical year and who have not received a pension of any type in their own right for at least two years. As regards disability pensions and special pensions for farmers, the precondition is that the persons have not received a pension of this type for two years. As regards the different types of disability pension, the precondition is that the persons have not received a disability pension of any type for two years.

Persons retiring on a part-time pension are not considered as all persons having retired on an earnings-related pension. Persons receiving a part-time pension are not included in the figures until the year when their pension is converted to some other pension based on their own work history, usually an old-age pension.

The partial old-age pension, introduced in 2017, is processed in the same way in the statistics as the part-time pension. That means that persons who have retired on a partial old-age pension in 2017 are not considered new retirees.

Pension benefit

The pension benefits in the earnings-related pension scheme are old-age, disability, special farmer’s, part-time, partial old-age and survivors’ pensions. More detailed information about pension types relating to the statistical year (for example basis for granting and age limits) has been presented in the figures for each statistical year in chapter 1.3 Pension benefits.

Pension sector

The tables in the publication include statistical figures covering the whole earnings-related pension scheme as well as figures by pension sector for the private and the public sector. More detailed information about the sectors is presented in the figures for each statistical year in chapter 1.1. General.

Recipients of an earnings-related pension are always included in the sector from which he or she receives at least one pension under survey. If a person receives a pension from both sectors, he or she is included in the figures for both sectors, but only once in the figures for the whole earnings-related pension scheme.

Persons who have retired on an earnings-related pension are registered in the sector-specific numbers, if retirement from the sector in question occurs in the statistical year. A person is registered in the numbers for the whole earnings-related pension scheme only once, in the statistical year during which the first pension begins.

A person insured for earnings-related pension benefits is always included in the figures of the sector in which said person works (and/or receives a pension). If a person is working (and/or receiving a pension) from both sectors, he or she is registered in the figures of both sectors.

Recipient of an earnings-related pension

Persons receiving a pension based on their own work history are those receiving old-age, disability, unemployment, special farmer’s, part-time or partial old-age pension during the last days of the statistical year. All recipients of earnings-related pension includes the aforementioned as well as recipients of survivors’ pensions. The earnings-related pension may be paid simultaneously with several different pension acts and types of pensions.

Size of the earnings-related pension

All monetary amounts given in the statistics are gross monthly pensions. Pension integration may have the effect of reducing an earnings-related pension if a person receives a pension under acts covering specific risks (Motor Liability Insurance Act, Occupational Accidents, Injuries and Diseases Act, Act on Compensation for Military Accidents and Service-Related Illnesses, Act on Compensation for Accidents and Service-Related Illnesses in Crisis Management Duties, Military Injuries Act). The reduction is made to the accrued earnings-related pension. These benefits may be so high that only a small amount or no earnings-related pension is paid out. Persons receiving zero earnings-related pension due to integration are nonetheless included in all figures in the statistics.

The earnings-related pensions of pension recipients and persons who have retired on earnings-related pensions include the euro amounts from both sectors of all pensions based on their work history and which were in payment at the end of the statistical year: old-age, disability, unemployment and farmers’ special pensions. The pensions include the euro amounts of both basic pensions and registered supplementary pensions. If the pensions of new retirees in the statistical year have ended before the end of the statistical year, the pensions include the amounts of all earnings-related pensions in payment when the pension ended.

Recipients of part-time pensions do not simultaneously receive other earnings-related pensions based on their work history. Therefore, the earnings-related pensions of those who receive and those who have retired on a part-time pension include the euro amounts of the part-time pension only.

In addition to the above, the total earnings-related pension includes any survivors’ pension that the pension recipients may receive. Statistics for the total earnings-related pension are included only in the tables for all earnings-related pension recipients (Tables 2 and 2.1) and earnings-related pension recipients residing abroad (Tables 11 and 12). The total earnings-related pension is not calculated for those who have retired on an earnings-related pension.

The average earnings-related and total earnings-related pensions are arithmetic means. Tables 5 and 16 also show the median pension. The median

pension is the pension observed at the mid-point of the material, i.e. half of the pension recipients receive a pension that is lower than the median and half receive a pension that is higher.

Social security agreement

An agreement between two countries that regulates the social security of individuals who are mobile between these countries.

Finland has bilateral social security agreements with Australia, Canada, Chile, China, India, Israel, Québec, South Korea and the U.S.A.

Unpaid period

Period for which a person receives a social security benefit for which pension accrues. Unpaid periods are, for instance, periods of parental allowances, periods of sickness allowance and unemployment allowance.

Quality description: Pensioners in Finland 2019

The statistics Earnings-related pensioners in Finland is published by the Finnish Centre for Pensions.

The Act on the Finnish Centre for Pensions states that the responsibilities of the institution include, for example, the compiling of statistics in its field of operation. The production of the statistics at the Finnish Centre for Pensions is handled by the Planning Department.

The Earnings-related pensioners in Finland is financed by the Finnish Centre for Pensions.

Relevance of statistical information

Statutory pension security in Finland consists primarily of two pension schemes: the earnings-related pension scheme and the national pension scheme. The pensions of the former scheme are based on earnings, while the pensions of the latter scheme are residence-based. Earnings-related pensioners in Finland provides an overview of the pensions paid within the Finnish earnings-related pension scheme.

In the private sector, the earnings-related pension provision is administered by earnings-related pension insurance companies, industry-wide pension funds and company pension funds. The Finnish Centre for Pensions is the central body of the earnings-related pension scheme. One of its assignments is to collect the information required for the administration of earnings-related pension matters for the purpose of handling the tasks prescribed to it.

Earnings-related pensioners in Finland covers the whole statutory earnings-related pension provision, as well as voluntary registered supplementary pension provision financed by the employer. Voluntary non-registered supplementary pensions paid by the employer are not included in the figures of these statistics, nor voluntary pension provision paid by the individuals themselves. In addition, the statistics do not include pensions from the national pension scheme and pension from workers compensation, motor liability and military accident insurance, so-called SOLITA pensions.

The statistics contain figures on the number and median pensions of earnings-related pension recipients and new retirees on an earnings-related pension. The statistics also contain information on earnings-related pension expenditure and earnings-related pensions paid abroad.

The main classifier in the statistics is the division of the earnings-related pension scheme into the private and the public sector. In addition, the following classifications are used in the statistics: pension benefit, pension size, gender and age. Disability pensions are classified by disease category. The regional classification for the earnings-related pension expenditure is based on the Finnish regions (http://stat.fi/meta/luokitukset/maakunta/001-2015/index_en.html). Pension recipients abroad are classified by country of residence and country groups.

The concepts and definitions used in the statistics are presented on the website of the statistics.

Correctness and accuracy of data

The data of this statistical publication is based on data in the pension register (composite data). The register contains registered data from pension decisions. The data is used to form pension periods and pensions which are registered in the statistics register. This statistics register forms the basis for pension statistics.

The regional data presented in the statistics is based on Kela’s population data. It is supplemented on the basis of the country of tax at source for pensions paid abroad, as reported by the pension providers.

Together with the earnings-related pension providers, the Register Services Department of the Finnish Centre for Pensions is responsible for the contents of the registers, the accessibility, scope, legality and accuracy of the data needed for the implementation of pension provision and the clarification of error conditions in the contents.

Arek Oy, a company jointly owned by the pension providers and the Finnish Centre for Pensions, is responsible for the information technology aspects of the registers.

Flaws detected in the statistics are immediately corrected on the website. In connection with the correction, information on the content and time of the correction is provided. If the error is substantial, a separate bulletin is issued.

Timeliness and promptness of published data

The more restricted statistics Earnings-related Pension Recipients in Finland is released once a month. The more comprehensive statistics Pensioners in Finland is released once a year during the first half of the year following the statistical year. The date of publication of the statistics is presented in the Release Calendar on the website of the Finnish Centre for Pensions at www.etk.fi/statistics, section ‘Release Calendar’.

Coherence and comparability of data

This statistical publication has been produced since 1996. Its time series are mainly comparable from that date. As for the number of earnings-related pension recipients, the time series extends back to the year 1979.

From the beginning, the statistics has covered the numbers of earnings-related pension recipients and new retirees, the mean pensions, as well as the pension expenditure of the earnings-related pension scheme. Over the years, the data content of the statistics has been extended. Data on disability pension decisions in the earnings-related pension scheme was added in 2007.

In 2005—2013, the statistics was published under the name Pensioners and Insured in Finland. As of the statistical year 2014, the data is published in two different statistical publications: Earnings-related pensioners in Finland and Persons insured for an earnings-related pension in Finland.

In 1999, the concept of new retirees was changed. It no longer included persons retiring on a part-time pension. Persons receiving a part-time pension are included in the figures for new retirees when they start to receive some other pension that is based on their own working life, usually an old-age pension.

The partial old-age pension, introduced in 2017, is processed in the same way in the statistics as the part-time pension. That means that persons who have retired on a partial old-age pension in 2017 are not considered new retirees.

Changes in earnings-related pension legislation must be taken into account when interpreting the statistics.

Read more:

The statistics use applicable general standard categorizations, e.g. by disease (ICD-10) and region (province, country or residence and country group).

In cooperation with Kela, the Finnish Centre for Pensions produces Statistics on Finnish Pensioners. It covers the pensions of both the earnings-related and the national pension schemes. The figures on recipients of an earnings-related pension, new retirees on an earnings-related pension and earnings-related pension expenditure in those statistics are consistent with the figures in these statistics.

Availability and clarity of data

The statistical data is released on the homepage of the statistics, in the statistical database of the Finnish Centre for Pensions and in publication Earnings-related pensioners in Finland.

A description of the statistics has been presented on the website of the Finnish Centre for Pensions, at www.etk.fi/statistics/earnings-related-pension-recipients/description.

The statistical service of the Finnish Centre for Pensions provides additional information about the statistics upon request per e-mail at tilastot(at)etk.fi.