Persons Insured for an Earnings-related Pension in Finland

One hundred thousand first-time insured under earnings-related pension acts

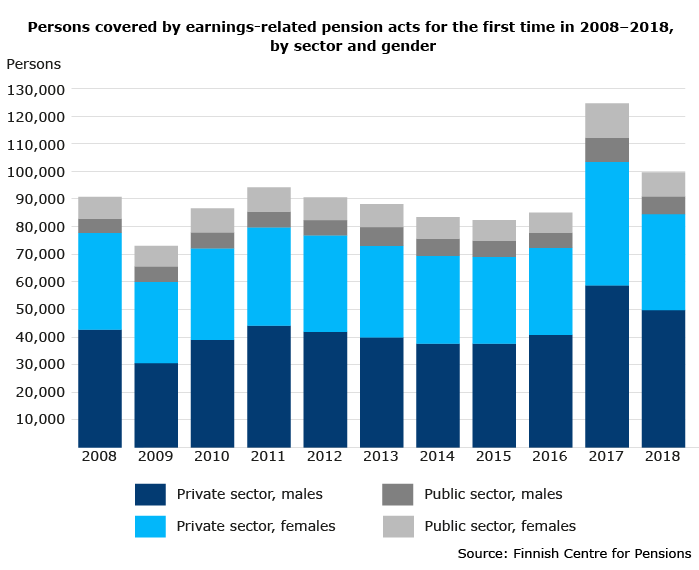

In 2018, nearly 100,000 persons were insured under the earnings-related pension acts for the first time. Most of the persons gaining first-time coverage under earnings-related pension acts are employed in the private sector. In 2018, they accounted for 85 per cent of all first-time insured.

The majority (59%) of the persons insured under the earnings-related pension acts for the first time were men. In the public sector, the majority (58%) were women.

In 2008–2016, a total of 82,000–94,000 persons gained first-time coverage under earnings-related pension acts per year. In 2009, however, when employment began to decline, the number of persons insured for the first time was only 73,000. In 2017 the qualifying age for earnings-related pension insurance was lowered to 17 years for wage earners. This increased the number of persons gaining first-time coverage: they numbered 125,000 that year.

At year-end 2018, approximately 3,741,000 persons aged 17–68 were covered by the earnings-related pension scheme. 51 per cent of them were men. The scheme includes all persons who, in the statistical year or earlier, were in employment in the private or public sector or in self-employment, or who already receive some pension based on their employment history.

In Finland, salaried work and self-employment must be insured for earnings-related pension benefits. The obligation to take out insurance starts at the beginning of the month following the 17th birthday and ends at the end of the month of the 68th birthday. For the self-employed, pension benefits accrue as of age 18.

Most recent publication:

- Persons insured for an earnings-related pension in Finland

- Press release 4 Dec 2019: Women’s monthly earnings 600 euros less than men’s

Statistical tables and figures:

- Persons insured for an earnings-related pension in Finland, pdf

- Statistical database of the Finnish Centre for Pensions

Statistical services provides further information:

Persons insured for an earnings-related pension in Finland

Producer: Finnish Centre for Pensions

Website: Persons insured for an earnings-related pension in Finland

Subject area: Social security

Part of the Official Statistics of Finland (OSF): Yes

Description

The statistics describe persons insured under the Finnish earnings-related pension scheme and employees’ insured earnings.

Data content

The statistics contain key numerical data on all persons aged 17–68 insured under the Finnish earnings-related pension scheme and on persons who have retired. In addition, the statistics provide information on employees’ insured earnings and pension accrued on the basis of benefits received during unpaid periods and under the Act on Compensation for Pension Accrual from State Funds for Periods of Caring for a Child Aged under Three and Periods of Study.

Categorizations

Private and public sector, earnings-related pension act, gender and age.

Methods of data collection and source

The statistics are based on data drawn from earnings and pension registers under the earnings-related pension scheme.

Update frequency

Once a year.

Time of completion or release

The statistics are released at the end of the year following the statistical year. For a more detailed schedule, consult the Release Calendar.

Time series

The statistics have been compiled since 2005. Time series for the private sector go back to 1977. The data are in the main comparable from 2007 onwards.

Key words

insurance, social insurance, pensions, earnings-related pensions, employment relationship, employees, wages, self-employed

Contact information

Concepts and definitions

Concepts relating to working

Covered by the earnings-related pension scheme

Persons covered by the earnings-related pension scheme refer to those who have been employed or self-employed during the statistical year or earlier. In other words, the earnings-related pension scheme covers those persons who are entitled to earnings-related pension at the time of the pension contingency or who already receive some pension based on their employment history.

Earnings-related pension act

Persons are classified as covered by all the earnings-related pension acts under which they have been insured during their employment history.

Earnings-related pension sector

Persons are classified into pension sectors based on the earnings-related pension acts applicable during their employment history. If they have been employed in both the private and public sector, they will be included in the figures for both sectors.

Employed at the end of the statistical year

A person employed at the end of the year is someone who has been employed in December (employment relationships based on a monthly notification) or whose employment relationship has ended or been in force at the end of the year (employment relationships based on an annual notification). Persons who have retired but are working or self-employed while drawing a pension are always classified as being employed.

Employed or self-employed

An employed person is someone who during the statistical period has been in employment that accrues earnings-related pension, or who has been insured for earnings-related pension under the Self-Employed Persons’ Pensions Act or the Farmers’ Pensions Act.

Employee

Employee refers to a person engaged in employment that falls under earnings-related pension acts other than the Self-Employed Persons’ Pensions Act (YEL) and the Farmers’ Pensions Act (MYEL). In other words, the definition effectively includes all employed persons except the self-employed and farmers. The definition of employee applied in the statistics also comprises special groups in the municipal sector under the Public Sector Pensions Act, such as persons holding an elected municipal office and informal carers. Furthermore, employees are defined as including family carers who have signed a commission agreement, even if they have not entered into an employment contract, within the meaning of the Employment Contracts Act, with a municipality or joint municipal authority.

First-time coverage under earnings-related pension acts

Persons gain first-time coverage under earnings-related pension acts when they enter their first employment subject to earnings-related pension acts after age 17 or self-employment after age 18.

First-time coverage under a specific earnings-related pension act

Persons gain first-time coverage under a specific earnings-related pension act when their first period of employment or self-employment under the said pension act is recorded as having started.

Not employed during the statistical year

A person who is not employed during the statistical year is someone who has not engaged in employment that accrues earnings-related pension or who has not been insured for an earnings-related pension based on the Self-Employed Persons’ Pensions Act or the Farmers’ Pensions Act. In addition, it is required that this person has been insured for an earnings-related pension before the statistical year or that they receive a pension based on their employment history.

Pension recipient

A pension recipient is a person who receives an earnings-related pension based on his or her employment history. A pension recipient may receive an old-age, disability or part-time pension or a farmer’s special pension.

Persons insured for earnings-related pension benefits

Persons insured for earnings-related pension benefits are those who during the statistical year or earlier have been employed or self-employed and who at the time of the pension contingency are entitled to an earnings-related pension. Typically, a person insured for earnings-related pension benefits has not yet retired, but even a retiree may be insured if he or she has been working while in retirement.

Working during the statistical year

Persons are considered to have worked during the statistical year if, during that time, they have engaged in employment that accrues earnings-related pension or have been insured for an earnings-related pension under the Self-Employed Persons’ Pensions Act or the Farmer’s Pensions Act.

Concepts relating to earnings

Annual and monthly earnings

All earnings statistics are for insured earnings from employment. Annual earnings are converted into monthly earnings by dividing insured earnings received during the year by the number of months in employment.

- Example. An employee was in employment from 20 August to 10 September, with insured earnings of 2,000 euros. In this case the monthly earnings entered in the statistics were 2,000 euros/2 = 1,000 euros/month, because the employment spell stretched across two different months. If the employment spell had taken place during one month (e.g. from 2 to 22 September), then the monthly earnings would have been 2,000 euros. If this was the employee’s only spell of employment during the calendar year, the annual earnings entered in the statistics would in both cases have been the same, i.e. 2,000 euros.

Benefits accrued from unpaid periods and under VEKL

Unpaid periods are periods during which a person receives a social benefit that, under certain conditions, will affect pension accrual. Unpaid periods include periods on a parental, a sickness or an unemployment allowance. The grounds on which various unpaid periods impact on final earnings-related pension income are set out in earnings-related pension acts.

Benefits accrued on the basis of child home care allowance and the completion of degrees and qualifications are funded by the State. These benefits are based on the Act on Compensation for Pension Accrual from State Funds for Periods of Caring for a Child Aged under Three and Periods of Study (VEKL).

The benefits received for unpaid periods and based on VEKL are recorded in the earnings-related pension scheme’s earnings register. Benefits for unpaid periods are also recorded for persons who have no employment history and who therefore are not covered by the earnings-related pension scheme.

Insured earnings

Insured earnings (i.e., pensionable income insured under the earnings-related pension scheme) include all compensation for employment paid in the form of wages, salaries, payment by results, or other consideration. The most noteworthy types of other consideration are various benefits in kind and holiday compensation, including compensations paid upon termination of employment, for instance for untaken saved leave. Earnings-related pension does not usually accrue on daily allowances and option arrangements, and they are not included in insured earnings. In the statistics presented here, insured earnings do include the employee’s pension contribution, even though the contribution did not count towards earnings-related pension accrual before 2017.

Other concepts

Age

Person’s age at the end of the statistical year.

Decile

Deciles are used to divide employees into ten equally large groups. Decile boundaries indicate the level of earnings beneath which lie 10%, 20%, … , 90% of all cases.

Median

When all employees are rank-ordered according to earnings, median earnings are the mid-point of the earnings distribution. There are exactly the same number of employees above the median as below the median. The median is less sensitive to outliers than the average. Especially in skewed distributions such as those of earnings, the median gives a better representation of central tendency than average.

Earnings-related pension acts, private sector

- TyEL Employees Pensions Act

- MEL Seafarer’s Pensions Act

- YEL Self-employed Persons’ Pensions Act

- MYEL Farmers’ Pensions Act

Earnings-related pension acts, public sector

- JuEL Public Sector Pensions Act came into force from the beginning of 2017. It combines and supersedes the Local Government Pensions Act (KuEL), the State Employees’ Pensions Act (VaEL) and the Evangelical-Lutheran Church Pensions Act (KiEL) and the special legislation applicable to employees of the Social Insurance Institution of Finland.

- Pension regulation for the regional government of Åland

- Pension regulation for the Bank of Finland

Quality description: Persons insured for an earnings-related pension in Finland 2018 (OSF)

The statistics Persons insured for an earnings-related pension in Finland is released by the Finnish Centre for Pensions.

The Act on the Finnish Centre for Pensions states that the responsibilities of the institution include the compiling of statistics in its field of operation. The production of the statistics at the Finnish Centre for Pensions is handled by the Planning Department.

The Finnish Centre for Pensions pays the costs of the statistics Persons insured for an earnings-related pension in Finland.

Relevance of statistical information

In Finland, statutory pensions consist mainly of earnings-related and national pensions. Earnings-related pensions are based on earnings from work while national pensions are residence-based. The statistics on persons insured for an earnings-related pension offer an overall view of persons aged 17–68 years who are covered by the Finnish earnings-related pension system.

In the private sector, earnings-related pension provision is administered by earnings-related pension insurance companies, industry-wide pension funds and company pension funds. Keva handles most of the public sector pensions. The Finnish Centre for Pensions is the central body of the earnings-related pension system. One of its tasks is to collect the information required for the administration of earnings-related pension matters for the purpose of handling the assignments prescribed to it.

The statistics Persons insured for an earnings-related pension cover the entire statutory earnings-related pension provision. They contain key numerical data on all persons aged 17–68 years insured under the Finnish earnings-related pension scheme and on employees’ insured earnings.

Persons covered by the earnings-related pension system have been divided into those insured for an earnings-related pension and those retired. The number of persons insured for earnings-related pension insurance is divided into two groups: those working and those who were neither working nor retired at the time of compiling the statistics. Other classifiers used in the statistics are earnings-related pension sector, earnings-related pension act and the person’s age and gender.

The statistics also provide data on other periods for which pension accrues, including registered unpaid periods and periods of VEKL benefits under the Act on Compensation for Pension Accrual from State Funds for Periods of Caring for a Child Aged under Three and Periods of Study. This data is presented by benefit type.

Average and median data on employees’ insured earnings are presented by earnings-related pension sector, earnings-related pension act, and employees’ age and gender. Earnings deciles are presented separately by gender and by age.

The terms and definitions used in the statistics are presented on the homepage of the statistics at www.etk.fi/statistics.

Correctness and accuracy of data

The statistics are based on a composite of data drawn from earnings and pension registers maintained under the earnings-related pension scheme. The data comprise information on working-age persons who were alive during the statistical year and who during the statistical year or earlier were in wage employment or self-employment that accrued earnings-related pension in the private or public sector.

Data on retired persons are obtained from the pension register and data on employment from the earnings register. Other information relevant to pension accrual is also obtained from the earnings register, such as unpaid periods. These data are reported among others by the Social Insurance Institution and unemployment funds. The data obtained from these registers are collected into a statistical register, which is used to compile the statistics on persons insured for an earnings-related pensions.

Together with the earnings-related pension providers, the Register Services Department of the Finnish Centre for Pensions is responsible for the contents of the earnings register, the accessibility, scope, legality and accuracy of the data needed for the implementation of pension provision and for addressing any errors in the contents. The register’s handling systems include permissibility and logical checks where the programme requires correction or verification of data. The error messages may also be comments that do not inhibit the registration of data.

Arek Oy is responsible for the information technology aspects of the earnings register. Arek Oy is a company jointly owned by the pension providers and the Finnish Centre for Pensions.

Flaws detected in the statistics are immediately corrected on the website. A separate bulletin is issued in the event of major errors.

Timeliness and promptness of published data

The statistics are released once a year towards the end of the year following the statistical year. The release dates are presented on the Finnish Centre for Pensions website at www.etk.fi/statistics under ‘Release Calendar’. The data in the statistics are final.

Coherence and comparability of data

The statistics have been compiled since 2005 and their data are comparable from 2007 onwards. Time series for the private sector go back to 1977. The statistics were previously released under the name Pensioners and Insured in Finland. Since the statistical year 2013 the data have been released in two different statistics: Earnings-related pensioners in Finland and Persons insured for an earnings-related pension in Finland.

Availability and clarity of data

The statistical data are released annually on the Finnish Centre for Pensions website. Some of the data are also released in the Finnish Centre for Pensions statistical database at http://tilastot.etk.fi/?lang=1.

A description of the statistics is presented on the homepage of the statistics at www.etk.fi/statistics.

For additional information contact the Finnish Centre for Pensions statistical service at tilastot(at)etk.fi.