Effective Retirement Age

Raising the retirement age defers retirement

Expected effective retirement age for 25-year-olds and 50-year-olds

In 2019, the expected effective retirement age within the earnings-related pension system was 61.5 years. It increased by 0.2 years since 2018. The expected effective retirement age of a 50-year-old grew by 0.3 years (63.4 years). This increase was mainly due to the rising general retirement age. For the second time, that age rose by three months. The effects of the rising retirement age have thus been as expected.

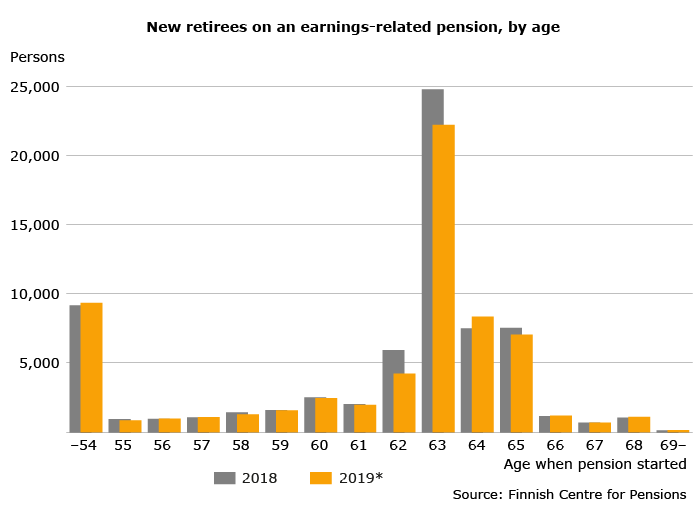

The rising retirement age has also reduced the number of persons retiring on an old-age pension. In 2019, there were 65,000 new retirees on an earnings-related pension. More than 44,000 of them retired on an old-age pension. The number of new retirees was reduced by 4,000 persons compared to in 2018. It was mainly the number of new old-age pension retirees aged 62 and 63 years that was reduced.

In 2019, the expected effective retirement age for 25-year-old men and women was 61.8 and 61.1 years respectively. Traditionally, the gender gap of the effective retirement age has been narrow, but now it has widened in a few years to 0.7 years as men are expected to retire at a later age. Especially at the early stages of working life, women run a slightly greater risk of retirement on a disability pension, which is why their effective retirement age is somewhat lower than that of men. In other respects, there are few differences between men and women in the time of retirement. There is no significant gap between the effective retirement ages in the private and the public sector.

Expected effective retirement age for 25-year-olds and 50-year-olds

| Year | 25-year-olds | 50-year-olds |

|---|---|---|

| 2010 | 60.4 | 62.3 |

| 2011 | 60.5 | 62.4 |

| 2012 | 60.9 | 62.7 |

| 2013 | 60.9 | 62.7 |

| 2014 | 61.2 | 62.8 |

| 2015 | 61.1 | 62.8 |

| 2016 | 61.1 | 62.8 |

| 2017 | 61.2 | 62.8 |

| 2018 | 61.3 | 63.1 |

| 2019 | 61.5 | 63.4 |

Statistical tables and figures:

- Presentation on effective retirement age (pdf)

- Statistical database of the Finnish Centre for Pensions

Read more:

Development of the expected effective retirement age

The rapid growth in the effective retirement age up to the early 2010s has been a result of, first and foremost, the elimination of some pension benefits. Both the unemployment pension and the individual early pension have been abolished. At the same time, the old-age pension has become the main route to retirement, and now people retire most frequently at age 63.

Several changes to the qualifying ages of different pension benefits realised in the 2000s have also affected the effective retirement age. On the one hand, the flexible old-age retirement age has allowed people to retire on an unreduced old-age pension earlier than before while, on the other hand, it has also allowed for people to work longer.

In connection with the 2005 reform, the qualifying age for an early old-age pension rose to 62 years. At the most, the old-age pension could thus be taken only one year early. After 2014, the early old-age pension has no longer been granted to persons born in 1952 or later.

Part-time pensions were no longer granted after 2016, at which time the qualifying age was 61 years. For those born in 1953 or earlier, the qualifying age was 58 years.

Some of the special pensions for farmers have also been abolished. At the turn of the century, 1,500 persons retired on a farmers’ special pension each year; in 2019, only 200 persons did so. The most recent special benefit that was abolished was the farmers’ early retirement aid. Under current rules, it is no longer granted.

Before the pension reform in 2017, the effective retirement age appeared not to rise any longer, but the reform changed the situation. Now the rising qualifying age for the old-age pension supports retirement at a higher age. The expected effective retirement age of both the 25- and the 50-year-olds has grown by more than two years compared to the level before the 2005 pension reform. This trend is expected to continue.

Future outlook

As a result of the 2017 pension reform, the qualifying age for the old-age pension will rise gradually by three months for each age group. For those born in 1955, the retirement age is thus 63 years and 3 months, and for those born in 1962, it is 65 years. Last year, the retirement age rose to 63 years and 6 months. The rising expected effective retirement age shows that the reform of the pension acts has clearly led to retirement at a later age.

In the years to come, the development of the effective retirement age is affected not only by the rising retirement age but also by the development in the number of granted new disability pensions. The improved health of Finnish people should reduce disability and thus raise the effective retirement age. Despite this, the number of new retirees on a disability pension rose in 2018. The trend continued in 2019. It is natural that raising the retirement age increases the number of new retirees on a disability pension among those who approach their retirement age. However, the increase in the number of new disability retirees under the age of 40 is particularly worrying.

In connection with the 2017 pension reform, the grounds on which disability pensions were granted were changed by merging the accrual and later retirement rules and techniques. This affects, in particular, the incentives for continued work for those who have already reached their retirement age. When Finns become more aware of how the increment for late retirement affects their pension, they may be more motivated to continue working.

The expected effective retirement age is also affected by the exceptional retirement ages of the public sector. On the one hand, the number of persons entitled to retire below the statutory retirement age will decline while, on the other hand, the individual retirement age of many people is below the current retirement age of 63 years in the public sector. This is a result of the consolidation of the new and old public-sector pension acts.

A new pension benefit – the partial old-age pension – was introduced in 2017. It can be taken as of age 61 (for those born in 1964, the qualifying age will rise to 62 years). It can be used to ease the workload in the last few years of work without significantly reducing one’s income. Many who have chosen to take out this pension benefit continue working. If the work continues past the retirement age, retirement can be deferred.

In 2019, more than 12,000 persons took out a partial old-age pension. However, the partial old-age pension does not directly affect the expected effective retirement age since the persons who have taken it are not considered to have retired. If they were, the expected effective retirement age would have been 0.2 years lower than that realised age in 2019.

An increase in the effective retirement age significantly depends on the economic and employment developments. In recent years, the employment rate of older people has developed favourably: new records have been set every year in the 2010s. The employment rates of the 55–64-year-olds in 2019 also give reason to expect that the effective retirement age will continue to rise. On the other hand, the employment rate of the 55–59-year-olds is historically high (79.1%) and did not rise in 2019.

Issues relating to the quality of working life and individual choices also affect the effective retirement age: will people continue working past their retirement age, and how do employers feel about this? A favourable economic outlook increases the demand for workers and thus offers better opportunities to continue working past the retirement age. It will surely also affect the attitudes of both workers and employers.

Statistical services provides further information:

Effective Retirement Age

Producer: Finnish Centre for Pensions

Website: Effective Retirement Age

Subject area: Social security

Part of the Official Statistics of Finland (OSF): No

Description

These statistics describe the effective retirement age under the Finnish earnings-related pension scheme.

Data content

Effective retirement age is described by three measures of central tendency: expected effective retirement age, median age and average age.

Categorizations

Sector of employment, gender, age, pension benefit

Methods of data collection and source

The statistics are based on register data from the earnings-related pension scheme.

Update frequency

Once a year.

Time of completion or release

The statistics are released in the February of the year following the statistical year. The exact date of publication is given in the release calendar, go to www.etk.fi/en/statistics-2/statistics/release-calendar/.

Time series

The time series for the statistics start from 1996. Private sector time series extend back to 1983.

Key words

social insurance, pension, earnings-related pension, retirement, effective retirement age

Contact information

Concepts and definitions

Expected effective retirement age

Expected effective retirement age is an indicator developed by the Finnish Centre for Pensions for the measurement of effective retirement age. The indicator is unaffected by the population age structure. It describes the average effective retirement age for persons of a certain age who are insured under the earnings-related pension scheme, proceeding from the assumption that the retirement and mortality rates for each age group are unchanged from the year of observation.

Expected effective retirement age is calculated for both 25-year-olds and 50-year-olds. The expectancy for 25-year-olds describes the effective retirement age for the whole population with earnings-related pension insurance, and it is used as the official indicator to describe changes in effective retirement age.

The expectancy for 50-year-olds is calculated for insured persons who have reached the age of 50. As persons who have retired before age 50 are not included in the calculation, the expectancy for 50-year-olds is always higher than for 25-year-olds. The difference describes the impact that people retiring at age 25–49 have on effective retirement age.

Average

Average retirement age is the arithmetic mean of the ages of new retirees. Average age is calculated based on age at the onset of retirement.

Median

Median retirement age is the midpoint observation for the dataset, i.e. half of the new retirees are younger and the other half older than the median. Median age is calculated based on age at the onset of retirement.

New retirees on earnings-related pension

New retirees on an earnings-related pension are defined as persons whose pension based on their own employment started during the statistical year, or whose pension eligibility has started earlier but who have only received a decision on their pension during the statistical year. A further requirement is that the person has not received any employment-based pension in one’s own right (excluding part-time pension and partial early old-age pension) for at least two years.

Figures for different types of pension benefit require that the person has not received the pension benefit in question for two years. For new retirees on an old-age pension, the person shall not have received any employment-based pension in one’s own right (excluding part-time pension and partial old-age pension) for two years.

Statistics for partial early old-age pension, which was introduced in 2017, are compiled using the same rules as for part-time pension. In other words, persons who have chosen to take early payment of a partial old-age pension are not counted as new retirees.

Survivors’ pensions are excluded from the examination of new retirees.

Sector-specific examinations are always focused on the sector concerned, i.e. the number of new retirees is determined based on pensions within that sector alone. In the case of the entire earnings-related pension system, it is required that the person has not received a pension from either sector for two years.

Insured persons

In this set of statistics persons insured for an earnings-related pension are defined as persons covered by the pension system who do not receive an employment-based pension (excluding part-time pension and partial old-age pension). The population insured for an earnings-related pension in the year under review is calculated based on the corresponding number at the end of the previous year.

The earnings-related pension scheme consists of the private and the public sector. Around three in four persons insured under this scheme are employed in the private sector and one in three in the public sector. Over the course of the year less than ten per cent work in both sectors.

Private sector pension acts:

- Employees’ Pensions Act

- Seafarers’ Pensions Act

- Self-Employed Persons’ Pensions Act

Farmers’ Pensions Act - Act on Farmers’ Early Retirement Aid

Public sector pension acts:

- Public Sector Pensions Act

- Pension acts concerning Bank of Finland employees,

- the regional government of the Åland Islands, and

- Members of Parliament and the Council of State.

The introduction of the Public Sector Pensions Act on 1 January 2017 combined and replaced the Local Government Pensions Act, the State Employees’ Pensions Act, the Evangelical-Lutheran Church Pensions Act and a separate act concerning employees of the Social Insurance Institution of Finland.

Quality description: Effective Retirement Age 2019

The statistics on effective retirement age are compiled and published by the Finnish Centre for Pensions.

The Act on the Finnish Centre for Pensions states that one of the agency’s roles is to compile statistics relating to its functions. Responsibility for the production of statistics at the Finnish Centre for Pensions rests with the Planning Department.

The costs of producing these statistics are borne by the Finnish Centre for Pensions.

Relevance of statistical information

These statistics describe the effective retirement age under the Finnish earnings-related pension scheme.

The phenomenon is described using three measures of central tendency: expected effective retirement age, median age and average age. The indicators used describe effective retirement age in different ways and are suited to different purposes.

Expected effective retirement age

Expected effective retirement age is an indicator developed by the Finnish Centre for Pensions for the measurement of effective retirement age. It describes the average effective retirement age for persons of a certain age who are insured under the earnings-related pension scheme, proceeding from the assumption that the retirement and mortality rates for each age group are unchanged from the year of observation. The indicator only reacts to changes in retirement rates: it is unaffected by changes in the population structure and other demographic phenomena.

Expected effective retirement age is calculated for both 25-year-olds and 50-year-olds. The expectancy for 25-year-olds describes the effective retirement age for the whole population with earnings-related pension insurance, and it is used as the official indicator to describe changes in effective retirement age.

Of the three indicators used, expected effective retirement age provides the most accurate measure of changes over time in effective retirement age.

Average

Average retirement age is the arithmetic mean of the ages of new retirees. Average age is calculated based on age at the onset of retirement.

Average is the most commonly used indicator in international comparisons of effective retirement age.

Median

Median retirement age is the midpoint observation for the dataset, i.e. half of the new retirees are younger and the other half older than the median. Median age is calculated based on age at the onset of retirement.

Median is well-suited to describing the typical effective retirement age in a highly skewed distribution.

New retirees on an earnings-related pension

A new retiree on an earnings-related pension is defined as a person whose pension based on his or her own employment started during the statistical year, or whose pension eligibility has started earlier but who has only received a pension decision during the statistical year.

Persons retiring on a part-time pension or taking early payment of a partial old-age pension are not counted as new retirees.

The concepts and definitions used in the statistics are presented on the statistics homepage at www.etk.fi/statistics/effective-retirement-age/concepts-and-definitions

Correctness and accuracy of data

The statistics are based on register data from the earnings-related pension scheme.

The Finnish Centre for Pensions has responsibility for the content of the central registers of the earnings-related pension scheme, as well as for the management and development of related operations. Provisions on the Finnish Centre for Pensions’ register-keeping duties are set out in the Act on the Finnish Centre for Pensions.

The numbers of new retirees, persons insured for an earnings-related pension and deceased persons in different age groups are derived from register data from the register sources. The analyses are based on total datasets.

Errors found in the statistics are immediately corrected online. A separate bulletin is issued in case of significant errors.

Timeliness and promptness of published data

The statistics are released once a year in the February of the year following the statistical year. The exact date of publication is given in the Finnish Centre for Pensions release calendar.

Coherence and comparability of data

The statistics have been compiled since 2003 and time series have been produced retrospectively back to 1996. Private sector time series extend to 1983.

The figures presented in the statistics are consistent with those in the statistics on Earnings-related pension recipients in Finland and Persons insured for an earnings-related pension in Finland.

Changes in earnings-related pension legislation must be taken into account when interpreting the statistics.

Read more:

Availability and clarity of data

The statistical data are released annually on the statistics homepage and in the Finnish Centre for Pensions statistical database at https://tilastot.etk.fi.

The statistics are described on the statistics homepage at www.etk.fi/statistics/effective-retirement-age/description.

For further information on these statistics, contact the Finnish Centre for Pensions Statistical Services at tilastot(at)etk.fi.

Definition and method of calculating expected effective retirement age

The expected effective retirement age describes the average effective age of retirement for insured persons of a certain age, assuming that the retirement risk and mortality for each age group remain unchanged at the level of the year of observation.

The expected effective retirement age is obtained by first calculating the mortality and retirement rates for each age group in the year of observation. These rates can then be used to calculate the number of people who in a group of insured persons of a selected size and age (say 100,000 insured persons aged 25 years) would retire within one year.

The number of persons insured at age 26 is then obtained by deducting from the original number those who have retired and the number of deceased persons based on mortality rates. This is repeated one year at a time through to retirement age until the notional number of new retirees is obtained for all age groups. The average age of these notional new retirees is the expected effective retirement age.

Expected effective retirement age is calculated as follows:

Until the end of 2004 the general retirement age in Finland was 65 years. For 2004 and earlier, therefore, the termination age used in the formula was 65 years. With the introduction in 2005 of flexible old-age retirement between ages 63 and 68, the upper limit in the formula was increased to 70 years. It is estimated that this hike in the termination age from 65 to 70 years increased the expected effective retirement age by just over 0.1 years.

Requirements set for expected effective retirement age

- The indicator reacts correctly to changes in the number of starting pensions. It falls if the number of starting pensions rises in any of the age groups below retirement age, and rises if the number of starting pensions falls.

- The indicator only reacts to changes in the number of starting pensions. It is unaffected by demographic phenomena such as the population age structure.

- The indicator reacts immediately to changes in the number of starting pensions since the calculations are based on starting pensions. If the calculations were based on the number of retired persons, the changes would be slow to show up in the results.

- The statistical data needed to calculate the indicator are available. The Finnish Centre for Pensions maintains a central register of all earnings-related pensions and persons insured for an earnings-related pension, which allows for calculations based on the number of starting pensions.

The indicator of expected effective retirement age satisfies these four basic requirements.

It might be tempting to add to this list the requirement of international comparability, but it may be difficult to obtain comparable data other than for the Nordic countries.

Calculations of expected effective retirement age for a very small population will also have limited value because the number of starting pensions should describe the probability of retirement for each age cohort of the population. It follows that calculations of expected effective retirement age for the personnel of an individual company, for example, are not meaningful.

Aim to defer effective retirement age

Since the 1990s, attempts have been made to curb the upward pressure on pension contributions. Extending working lives and raising the retirement age have become key means to reach this goal. Changes in the length of working lives are monitored primarily through employment rates and the effective retirement age in the form of the expected effective retirement age, developed at the Finnish Centre for Pensions.

- The long-term goal of the 2005 pension reform was to postpone retirement by 2-3 years. No specific time frame was set.

- In the spring of 2009, the Finnish Government and labour market organisations negotiated the details: by 2025, the expected effective retirement age is to rise to at least 62.4 years. Growing at a steady rate, the expected effective retirement age should rise by nearly 0.2 years each year.

- In the 2011 government programme, the goal for the rise of the expected effective retirement age was repeated. In the 2013 structural policy programme, the goal of 62.4 years by 2025 was confirmed. To achieve the goal, an annual growth of an ample 0.1 years was required.

- In the justifications of the 2017 pension reform, the goal for the expected effective retirement age was again stated as 62.4 years. To reach the goal, a steady annual growth of 0.15 years is required.