Time series

The Finnish Centre for Pensions publishes in the statistical database time series on pensions paid, premium income, wage sums, pension assets and number of pension providers since 1962 onwards. For the main part, the earnings-related pension acts came into force in the 1960s.

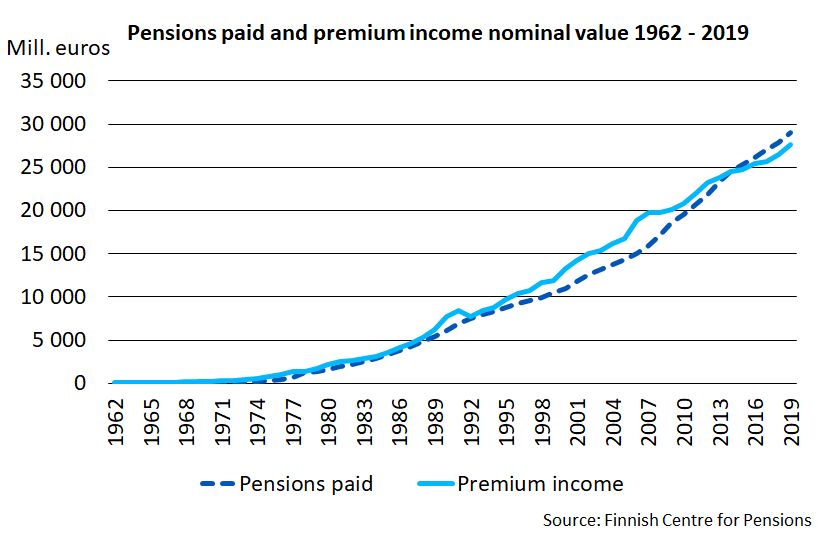

In 2019 pensions paid out was EUR 29 045.4 million, premium income EUR 27 387.5 million, pension assets EUR 217 998.4 million and insured wagesum EUR 92 354.1 million. At the end of the year 2019 number of valid pension providers was 29.

In Finland, earnings-related pension system is decentralized and there are several earnings-related pension acts. The authorised pension providers, special pension providers, company pension funds and industry-wide pension funds are responsible for the implementation of private-sector statutory earnings-related pensions. Keva implements public-sector earnings-related pensions for employees in the municipal sector, the State, the Evangelical Lutheran Church and Kela.

Employers, workers and the self-employed pay insurance contributions, which are used to fund pensions. In addition to pension assets and their investment returns, the Employment Fund and the State contribute to the financing of pensions.

Statistical tables:

Time series

Producer: Finnish Centre for Pensions

Website: Time series

Subject area: Financing and Insurance

Part of the Official Statistics of Finland (OSF): No

Description

In Finland employers, workers and the self-employed pay insurance contributions, which are used to fund pensions. In addition to pension assets and their investment profits.

The statistic includes timeseries of financing the private and public-sector pension scheme. The figures are since 1962 onwards when the essential earnings-related pension acts came into force.

Data content

The statistic includes time series of the earnings-related pension scheme’s private and public-sector on pensions paid, premium income, pension assets, wage sums and pension providers.

The figures corresponds to the figures in the cash flow and financial statement tables since 2007.

Categorizations

The statistic is classified according to the pension scheme. The private-sector pension schemes are TEL, LEL, TaEL, TyEL, MEL, YEL, MYEL. Public-sector pension schemes municipals and state are shown separately. Other public-sector pension schemes (church, Kela and Bank of Finland) are shown as a unity.

Methods of data collection and source

The data is based on the registers of the Finnish Centre for Pensions and the financial statements of the pension providers. In addition to the data received from the pension providers and the Finnish Pension Alliance TELA

Update frequency

Once a year.

Time of completion or release

In June following the statistical year.

Time series

The statistical data is available from 1962 onwards

Key words

Claims paid, premium income, pension assets, wage sums and pension providers.

Time series

Concepts and Definitions

In Finland, the earnings-related pension accrues from almost all gainful employment, and there are several earnings-related pension acts. Wage earners earn earnings-related pension security mainly under the Employees Pensions Act (TyEL), the Seafarer’s Pensions Act (MEL) and, as of the beginning of 2017, the Public Sector Pensions Act (JuEL). The Public Sector Pensions Act combines the rules on earnings-related pensions of the Local Government Pensions Act (KuEL), the State Employees’ Pensions Act (VaEL), the Evangelical-Lutheran Church Pensions Act (KiEL) and the Act on the Social Insurance Institution of Finland (KelaL).

Self-employment is insured under the Self-Employed Persons’ Pensions Act (YEL) or the Farmers’ Pensions Act (MYEL).

Claims paid

Since 2006 onwards earnings-related claims paid is according to the data compiled from pension providers financial statements and the data reported to the division of cost.

Claims paid in 1962 -2005 are based on the registers of the Finnish Centre for Pensions according to the paying pension provider.

The table is divided to basic provision and claims paid based on registered supplementary provision (TEL-L and YEL-L).

The special farmers’ claims paid comprises early retirement pensions, early retirement aid and early retirement increases. Special farmers’ claims are only paid in the private sector of the earnings-related pension scheme.

State includes the claims paid according to the State Employees’ Pensions Acts (VEL, VaEL and JuEL).

Municipals include the claims paid according to the Local Government Pensions Acts (KuEL, KVTEL and JuEL).

Municipals and states old claims paid are presented separately.

Other public sector includes the claims paid according to Bank of Finland, The Evangelical-Lutheran Church Pensions Act (KiEL and JuEL) and the Act on the Social Insurance Institution of Finland (KelaL and JuEL).

VEKL includes pension accrued for

- the child home care allowance paid until the child turns three years if the parent takes care of the child him or helself, and

- studies for 3-5 years if they have led to a degree.

The State finances the benefit.

Premium income

Premium income is divided into:

- Employers’ contribution

- Employees’ contribution

- Entire wage earners’ contribution

- Self-employed persons’ premium

- State’s component

- Contribution from TR

- Transition contribution income

- Total premium income

TEL/LEL/TaEL/TyEL and MEL premium income is according to the financial statements. Registered supplementary provision TEL-L is included in TEL/LEL/TaEL/TyEL.

YEL and MYEL premium income is according to the financial statements. YEL includes registered supplementary provision YEL-L. Grant recipients also insure their earned income under MYEL since 2009.

Municipals premium income is since 1966 onwards. The premium income is according to the financial statements.

State premium income figures are according to the State Pension Fund’s financial statements. The State employers paid first time the contributions to the State Pension Fund in 1991.

Other includes the Social Insurance Institution of Finland (Kela), the Evangelical-Lutheran Church and Bank of Finland.

Kela started to pay employers contributions in 1991. Figures are according to Kela’s financial statements.

The Evangelical-Lutheran Church premium income is since 1966 onwards The premium income in 2007 – 2015 is according to the financial statements. The premium income in 1966 – 2006 is calculated using the average contribution rate and wage sum.

Bank of Finland premium income is since 1990 onwards. The premium income in 2005 – 2015 is according to the financial statements. The premium income in 1966 – 2006 is calculated using the average contribution rate and wage sum.

Pension assets

TyEL assets

Since 2013 onwards pension assets include the technical provisions added to the solvency capital.

Between 2006 – 2012 pension assets include the technical provisions added to the solvency margin.

Between 1997 – 2005 investments at fair value are presented as the pension assets.

Between 1962 – 1996 technical provision is presented as the pension assets.

MEL assets

Since 2013 onwards pension assets include the technical provisions added to the solvency capital.

Between 2006 – 2012 pension assets include the technical provisions added to the solvency margin.

In 1962 – 2005 technical provision is presented as the pension assets.

YEL assets

Technical provision is presented as the pension assets.

MYEL assets

Technical provision is presentedas the pension assets.

Municipals assets

Pension Liability Fund is used as the pension assets.

State’s assets

Since 1990 investments at fair value are presented as the pension assets. The State Pension Fund invests the assets.

Other assets

Other includes church since 1962, Kela since 1991 and Bank of Finland assets since 1988. Investments at fair value are presented as the pension assets.

Wage sums

Employers report the wage sums of their employees to the cost distribution clarification. The self-employed and farmers pay an earnings-related pension contribution according to their insured income.

State includes only the state employee’s wage sums according to VEL,VaEL and JuEL since 1990 onwards. The wage sum is according to the cost distribution clarification since 2006 onwards.

Municipals include wage sums according to KuEL, KVTEL and JuEL. The wage sum is according to the cost distribution clarification since 2006 onwards.

Other public sector includes wage sums according to the Evangelical-Lutheran Church (KiEL and JuEL), the Social Insurance Institution of Finland (KelaL and JuEL), the regional government of Åland and Bank of Finland (SPELAS) since 1962 and the Orthodox Church since 2006.

Pension providers

Pension providers is the number of pension providers operating at the last day of the statistical year. The pension insurance companies also insure according to the registered supplementary provision TEL-L and self-employed persons’ act YEL. Only some of the industry-wide pension funds insure also YEL.

Since 1.1.2012 onwards Keva has handled the municipals, the state, the Evangelical-Lutheran Church and Kela employees pensions. As of the beginning of 2017 the regulations of the Local Government Pensions Act (KuEL), the State Employees Pensions Act (VaEL) and the Evangelical-Lutheran Church Pensions Act (KiEL) were incorporated into the Public Sector Pensions Act (JuEL).

According to the KVTEL/KuEL/JuEL all Finnish cities, municipals and municipal federations, as well as the majority of municipal associations and limited companies are insured.

According to the VEL/VaEL/JuEL state employees are insured.

According to the KiEL/JuEL employees of the Evangelical-Lutheran Church are insured.

Other includes the Social Insurance Institution of Finland (Kela), Bank of Finland, the Orthodox Church and the regional government of Åland.