Statistics on Pensioners in Finland

Statistics on Pensioners in Finland includes data on all recipients of earnings-related and national pensions, new pension recipients and pension expenditure. The data on pension recipients living in Finland and abroad are presented separately. The statistics is produced in co-operation with the Social Insurance Institution of Finland (Kela).

Average total pension in Finland 1,716 euros

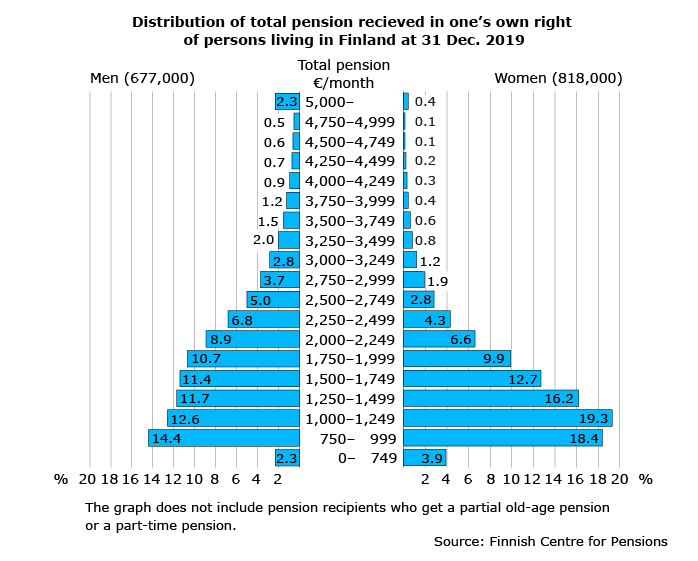

In 2019, pension recipients received an average total monthly pension of 1,716 euros and a median monthly pension of 1,497 euros. Men got an average monthly pension of 1,937 euros and women 1,533 euros (20% less).

Half of the pension recipients received a monthly pension of less than 1,500 euros. Of them, nearly two thirds were women. Eight per cent of the pension recipients received a monthly pension higher than 3,000 euros. A clear majority of them were men.

Read more:

Tables in statistical database:

- Number of pension recipients

- Number of new retirees

- Size of pension recipients’ pension

- Size of new retirees’ pension

- Share of population receiving a pension

- Pension recipients living abroad

Read more in the e-publication of the Finnish Centre for Pensions and Kela:

Statistical services provides further information:

Statistics on Pensioners in Finland

Producers: Finnish Centre for Pensions and the Social Insurance Institution of Finland

Website: Statistics on Pensioners in Finland

Subject area: Social security

Part of the Official Statistics of Finland (OSF): Yes

Description

The statistics offers a general overview of recipients of earnings-related and national pensions in Finland.

Data content

The statistics includes data on all recipients of earnings-related and national pensions and also new pension recipients.

The data on pension recipients living in Finland and abroad are presented separately.

Classification

Pension scheme; pension benefit; pension amount; gender, age, nationality and country of residence of pension recipient; disease classification ICD-10; regional classification: municipality, province

Methods of data collection and source

The statistics is based on the registers of the Finnish Centre for Pensions and the Social Insurance Institution of Finland.

Update frequency

Once a year.

Time of completion or release

The statistics on pension recipients is released in the spring following the statistical year. The data on new retirees is released in year after the statistical year. For a more detailed schedule, consult the Release Calendar

Time series

The statistics has been released since 1981. The statistics has been supplemented with data on new retirees as of 2001.

For the main part, the time series of the statistics are comparable. The Quality Description (section “Coherence and comparability of data”) of the statistics includes more detailed information on the comparability of the time series.

Key words

social insurance, pension, earnings-related pension, national pension, old-age pension, disability pension, unemployment pension, farmers’ special pension, part-time pension, survivors’ pension, retirement

Concepts and definitions

Statistical units

Pension recipient

A pension recipient is a person who gets a pension in their own right or a survivors’ pension on the last day of the year of statistics. One person may get simultaneously pensions both under several different pension acts and of several different types.

Persons getting a pension in their own right get old-age, partial old-age, disability, unemployment or part-time pensions, or special pensions for farmers.

All pension recipients include persons who get pensions in their own right as well as the recipi-ents of survivors’ pensions.

A person who simultaneously gets a pension paid by Kela and an earnings-related pension is a person who gets a pension under review from both schemes. For example, in the table for disability pension recipients, the pension from both schemes must be a disability pension.

New retiree

A new retiree is a person whose pension in their own right (other than a part-time or a partial old-age pension) started during the year of statistics. A further criterion is that the person has not received a pension in their own right (excluding a part-time and a partial old-age pension) for at least two years. A person is considered a new retiree from the earnings-related or nation-al pension scheme during the year in which the transfer from said scheme took place. The cri-terion for all new retirees is that they have not received pension in their own right from either scheme for at least two years.

Persons who have started to get a part-time or a partial old-ge pension are not considered to be retired, so they are not included in the total number of new retirees. They will noo be included in the number of new retirees until the year in which they start to get some other pension in their own right.

Factors describing the pension recipients

Age

The pension recipient’s age is the age at the end of the year of statistics. A new retiree’s age is, in general, the person’s age when the pension starts. When calculating the share of new retirees in the population per age group, the person’s age at the end of the year of statistics is used.

The average age is the arithmetic mean of the ages of new retirees.

The median age is the observation at the mid-point of the material, i.e. half of the new retirees are younger than the median age and the other half are older.

Average pension

The pension can be made up of an earnings-related pension, a national pension paid by Kela, special provision benefits relating to these pensions, or a guarantee pension. The average pension is the arithmetic mean of the gross pensions.

The average pension in one’s own right of those who get a pension in their own right includes the euro amount of the pensions in one’s own right (excluding part-time and partial old-age pensions). The average pension in one’s own right of new retirees is calculated as the average value of pensions that began during the year and were in force on the last day of the year. The calculations do not include pensions that both began and ended during the year.

The average total pension of those who get a pension in their own right includes, besides the aforementioned, also the amount of survivors’ pensions and the amount of guarantee pen-sions, child increases and front-veterans’ supplements paid by Kela.

The average survivors’ pension of the recipient of a survivors’ pension only includes the euro amount of the survivors’ pension, and the average total pension includes all benefits paid as pensions to the recipient of a survivors’ pension

Illness

The categorizing of persons receiving disability pension or having retired on disability pension by disease is based on the main disease which is the basis of the pension. The data on diseases is primarily based on the diagnosis of the earnings-related pension scheme.

The main groups and some subgroups of diseases are shown for the diseases.

Since 1996, the diagnoses and the corresponding codes are based on the ICD 10 classification of diseases. Disability pensions granted before 1996 are based on the previous ICD 9 classification. The codes according to the old classification have been as closely as possible placed in the correct category in the new classification.

Regional division

In the statistic, regions are categorized based on the regional categorization valid at the end of the year of statistics. The domicile of a person equals the domicile of the last day of the year of statistics. Data on domiciles is available from the population data of Kela.

In the statistic, countries of residence are categorized based on the country categorization valid at the end of the year of statistics. In pensions paid abroad, the person’s country of residence is the country of residence on the last day of the year of statistics. Data on country of residence is available from the population data of Kela, completed with information received from the pension providers.

Citizenship

Citizenship is categorized based on the currently valid citizenship at the end of the year of statistics. The citizenship data is acquired from Kela’s population data and completed with information received from the pension providers.

Population share

Population shares of pension recipients are calculated for pension recipients resident in Finland in per cent of the population insured for national social security benefits. The population more or less covers the resident population of the country but includes also Finnish citizens tempo-rarily living abroad.

Quality description: Statistics on Pensioners in Finland 2019

The Statistics on Pensioners in Finland is published by the Statistics Unit of the Planning Department of the Finnish Centre for Pensions (ETK) in co-operation with the Statistics and Data Warehousing Section of the Social Insurance Institution of Finland (Kela).

The obligation to compile statistics is prescribed to both Kela and the Finnish Centre for Pensions. The Act on the Finnish Centre for Pensions states that one of the responsibilities of the centre is to compile statistics in its field of business. The production of the statistics at the Finnish Centre for Pensions is handled by the Planning Department. The Act on the Social Insurance Institution states that the tasks of Kela include to compile statistics, projections and forecasts.

The production of the statistics is financed jointly by the Finnish Centre for Pensions and Kela.

Relevance of statistical information

The statutory Finnish pension security primarily consists of two statutory pension schemes, the earnings-related pension scheme and the national pension scheme. The Statistical Yearbook of Pensioners in Finland gives a comprehensive overall picture of the pensions paid by the Finnish statutory earnings-related and national pension schemes. It collects the data on pensions received by a person from different parties into an integrated whole. The statistics are almost exhaustive with regards to statutory pension security.

In the private sector, earnings-related pensions are administered by authorized pension providers as well as company and industry-wide pension funds and, in the public sector, mainly by Keva. The Finnish Centre for Pensions functions as a centre for the earnings-related pension scheme and collects the information required for the administration of earnings-related pension matters. The national pension scheme is managed by Kela.

Statutory pensions also include benefits paid based on the Workers’ Compensation Insurance Act, the Motor Liability Insurance Act, the Act on Compensation for Military Accidents and Service-Related Illnesses and the Act on Compensation for Accidents and Service-Related Illnesses in Crisis Management Duties. Of these special provision pensions, only the benefits paid simultaneously with the earnings-related or national pension are included in the statistics. In other words, persons who get special provision pensions alone are not included in the statistic. The Finnish Motor Insurers’ Centre and the Finnish Workers’ Compensation Center collect the necessary information needed for statistical compilation from the traffic and accident insurance providers.

The Guarantee Pension Act came into force on 1 March 2011. It guarantees a minimum pension for all resi-dents of Finland. Only those receiving a guarantee pension along with an earnings-related or national pension are included in this statistic. Persons receiving guarantee pension alone are not included in the statistic. It is Kela who pays the guarantee pension.

In addition to the statutory pensions, the statistic also includes the voluntary registered supplementary pension security financed by the employer. On the other hand, voluntary non-registered supplementary pension security paid by the employer is not included in the figures of this publication, nor voluntary pension provision paid by the individuals themselves.

The statistic contains data on the numbers, the average pensions and the pension size distributions of persons who received a pension at the end of the year. Additionally, it contains numerical data on new retirees during the year.

The following categorizations are used in the statistic: pension scheme, pension benefit, gender and age of the pension recipient, size of the pension, regional distribution and, for disability pensions, disease category (for disability pensions).

This statistical publication is aimed at decision-makers, planners and researchers in social security and specialists in the pension field. The information is likely also of interest to the media, pensioner organisations and others with an interest in the field.

Correctness and accuracy of data

The statistics in the publication are based on the aggregate data of pensions paid by the Social Insurance Institution and the earnings-related pension scheme, and the recipients of these pensions. The statistical data is formed from the joint statistical data warehouse (pension recipients) and the statistical register of new retirees (new retirees).

The data warehouse for joint statistics contains data on all persons who drew a pension from the earnings-related or the national pension scheme on the last day of the year, as well as on the annual pension expenditure. The statistical register of new retirees contains data on all pensions that have started during the year. The Finnish Centre for Pensions maintains these statistical registers together with Kela.

The data warehouse for joint statistics has been assembled from the basic statistical register of the Finnish Centre for Pensions (including old earnings-related pensions of the State), and the Kela benefits and guarantee pensions from the statistical register of the pension benefit database of Kela (including guarantee pensions.) Military injury pensions and earnings-related pensions based on the so-called old rules (excl. old earnings-related pensions of the state) come from the pension database of Kela. Information about pensions according to the Motor Liability Insurance Act and the Workers’ Compensation Insurance Act is sent annually by the Finnish Motor Insurers’ Centre and the Finnish Workers’ Compensation Center.

Statistical register information on new retirees has been collected from the pension contingency register of the Finnish Centre for Pensions and the statistical pension register of Kela.

The data in the basic statistical register of the Finnish Centre for Pensions comes from the pension register of the Finnish Centre for Pensions, where the data is transmitted from the pension providers making the pension decisions. The pension contingency register is managed by Arek Oy, jointly owned by the pension providers and the Finnish Centre for Pensions. The register service department of the Finnish Centre for Pensions is responsible for the content of the pension register. The processing systems include authenticity and logical checks, where the programme requires correction or verification of the data. The error messages may also be comments that do not inhibit the registration of the decision.

Correspondingly, the data in the statistical registers of Kela is based on the pension decisions made in its offices and at the central administration. The pension processing systems of Kela have been made primarily for the payment of pensions. Efforts are made to prevent errors from occurring by promoting close co-operation between experts responsible for benefits and statistics.

Flaws detected in the statistics are immediately corrected in the web service. If the error is substantial, a separate notification is delivered.

Timeliness and promptness of data

The statistic on Finnish pensioners is published once per year. The time of publication is listed in the publication calendar of the Finnish Centre for Pensions at www.etk.fi/statistics and on the web pages of Kela atwww.kela.fi/statistics. The data in the statistical yearbook are final.

Coherence and comparability of data

The statistic has been produced since 1981. From the beginning, it has depicted the numbers and average pensions of individuals receiving pension from the earnings-related and/or national pension schemes. Data on new retirees was added in 2001. Over the years, amendments have been made to both pension schemes and the scope of the statistic has been broadened. The time series of the statistic are primarily comparable.

The comparability of the time series is affected by e.g. the following changes:

- In 1991 the statistic was completed by adding the money amounts of SOLITA pension to the pensions of individuals receiving earnings-related or national pension. SOLITA pensions are included in average pensions and the size distributions of pensions. They are primary to the earnings-related and national pensions, meaning that the addition complements the pension security of said individuals to a significant degree.

- In 1996 a new concept was introduced, ‘pension in one’s own right’, that corresponded to the previous concept ‘pensioners in their own right and/or special pensioners’.

- Since the start of 2001, the basic share of the national pension has no longer been paid. The change did not affect the total number of pensioners, but transferred those receiving both earnings-related pension and national pension to those receiving only earnings-related pension. Removal of the basic share was due to the national pension becoming deductible by the earnings-related pension at the start of 1996, when the national pension was no longer granted without an additional share. Prior to 1 January 1996, national pensions in payment without additional shares were gradually reduced over a period of 5 years.Along with the removal of the basic share, since 1996, national pension paid as housing or care allowances, child increase or front-veterans’ supplement has not been included among national pensions in this statistic.

- Since 2008, the concept of national pension changed and the housing or care allowance of a pensioner is no longer counted among pensions. They are thus not included in the figures of this statistic or in the pension figures in the other statistics of Kela. The change slightly reduced average pensions.

- Since 2011, when the Guarantee Pension Act came into force, the cash amount of the guarantee pension was added to the total pension of pensioners receiving earnings-related and/or national pension (not to pension in one’s own right or survivors’ pension.) The change raised the averages of total pensions.

Concepts and definitions have been presented on the statistics page.

The statistic uses applicable general standard categorizations, e.g. by region and disease (ICD-10).

Information about earnings-related pensions in the statistic is congruent with the information in the statistic Pensioners in Finland, produced by the Finnish Centre for Pensions.

Information on national pensions differ with regards to the concept ‘new retirees’ in the pension statistic of Kela. The statistics of Kela utilize the concept ‘ new pensions’.

Accessibility and transparency of data

The data of the statistics is published on the website and statistical database of the Finnish Centre for Pensions (www.etk.fi/statistics and tilastot.etk.fi) and the statistical database of Kela (www.kela.fi/statistics>Statistical database Kelasto).

A description of the statistic has been presented on the website of the Finnish Centre for Pensions.

Additional information about the statistic is provided by the statistical service of the Statistical Unit of the Finnish Centre for Pensions, tilastot@etk.fi and the statistical data service of Kela,tilastot@kela.fi.

More on other sites:

Description of the pension system in 2019

The Finnish statutory pension system consists of the statutory earnings-related pension, the national pension and the guarantee pension. In addition to these, pensions are paid based on the Motor Liability Insurance Act, the Workers’ Compensation Act, the Act on Compensation for Military Accidents and Service-Related Illnesses and the Act on Compensation for Accidents and Service-Related Illnesses in Crisis Management Duties.

The earnings-related pension scheme covers all employees, self-employed persons and farmers whose employment exceeds the minimum requirements laid down by law.

The national pension and the guarantee pension secure a basic livelihood if the retiree has accrued no or only a small earnings-related pension. The national pension scheme covers all persons who are permanently residing in Finland.

Earnings-related pension scheme

Pension accrues for work carried out between the ages of 17 and 67. For the self-employed, pension accrues as of age 18. The pension is calculated based on the person’s earnings for each year and an age-specific accrual rate. Pension also accrues based on certain unsalaried periods, such as periods of unemployment or study. A person can simultaneously receive earnings-related pensions under several pension acts and of several different types.

The Ministry of Social Affairs and Health annually confirms the earnings-related pension index and the wage coefficient. The earnings-related pension index is used to revalue the euro amounts of pensions in payment at the beginning of January each year. The wage coefficient has been used as of 2005 to calculate pensions and to revalue earnings from work, self-employed persons’ confirmed income and the limit amounts laid down in the acts on the earnings-related pension. In 2018 the earnings-related pension index was 2585 and the wage coefficient 1,417.

The national pension scheme

Pension financing

The financing of private sector earnings-related pensions is based on insurance. The financing is partly funded and partly pay-as-you-go. The expenditure of the scheme is thus covered through contributions and interest yields on the funds. Contributions under TyEL and MEL are paid jointly by the employer and the employee. Contributions under YEL and MYEL are paid in their entirety by the self-employed. The State participates in the financing of the pensions for self-employed persons insofar as the contributions and interest yield on the funds are not sufficient to finance the pensions.

Until the 1990s, the financing of public sector pensions was based on the pay-as-you-go system. In other words, enough pension contributions or taxes were collected to finance pensions in payment. Municipal pensions are the responsibility of the member entities Since 1988, in preparation for the increasing pension expenditure, assets have been collected from the member entities into a pension liability fund. Since 1990, state pension contributions have been accumulated into the State Pension Fund. Pensions are not paid directly from the State Pension Fund but from the state budget. Employees and officials of the public sector also participate in the financing of pensions by paying the employee’s pension contribution.

Kela pensions are financed by the State.

Pension legislation as at 31 December 2019

Earnings-related pension acts

Private sector

- TyEL Employees Pensions Act

- MEL Act Seafarer’s Pensions Act

- YEL Self-Employed Persons’ Pensions Act

- MYEL Farmers’ Pensions Act

- LUTUL Act on Farmers’ Early Retirement Aid

Public sector

- JuEL Public Sector Pensions Act

- OrtKL Orthodox Church Act

- SP Pension regulation for the Bank of Finland

- KELA Pension regulation for Kela

- Pension regulation for the regional government of Åland

National pension acts

- KEL National Pensions Act

- REL Front-Veterans’ Pensions Act

- URL Act on Front-Veterans’ Supplement Payable Abroad

Special provision acts

The Motor Liability Insurance Act compensates personal injuries caused by motor vehicles used in traffic. Compensations are paid based on the Workers’ Compensation Act for accidents at work (on the job or on the way to and from work) or occupational diseases.

Farmers are covered by the Accident Insurance Act for Farmers. Military injuries and service-related illnesses occurring in military service, non-military service and women’s voluntary military service are compensated under the Act on Compensation for Military accidents and Service-Related Illnesses. Accidents and service-related illnesses occurring in crisis management operations are compensated under the Act on Compensation for Accidents and Service-Related Illnesses in Crisis Management Duties.

Act on Guarantee Pensions

The guarantee pension ensures a minimum pension of a certain size for a person resident in Finland. Kela pays out the guarantee pension, which is financed by State funds. The guarantee pension is adjusted annually with the national pension index.

Pension benefits in 2019

Old-age pension

In the earnings-related pension scheme, it is possible to retire on an old-age pension flexibly between the ages of 63 and 68. The retirement age rises gradually from 63 years to 65 years with 3 months per age group. The first age group whose retirement age rises are those born in 1955.

In the public sector of the earnings-related pension scheme, it is possible to retire according to earlier agreement at an individual or occupational retirement age. Under MELA, it is possible to retire at an accrued retirement age.

From the beginning of 2017, it has been possible to retire on an earnings-related partial old-age pension. This pension is available to persons born in 1949 or later who have reached the qualifying age for the benefit, determined based on year of birth. Eligible persons may not receive any other pension in their own right at the start of the partial old-age pension. The amount of partial old-age pension is 25 or 50 per cent (based on the individual’s own choice) of the earnings-related pension accrued at the time of retirement. An early retirement reduction is made to the pension if it is taken out before the retirement age of the age group concerned. There are no rules regarding employment; partial old-age pension recipients may continue to work if they want to.

In the national pension scheme, the age limit for the old-age pension is 65 years. Persons born before 1962 can take out their national old-age pension early. The age threshold is 63 years for persons born before 1958 and 64 years for persons born in 1958–1961. Early retirement reduces the pension permanently.

Retirement on old-age pension can also be deferred. The earnings-related old-age pension is increased if taken out late, after reaching the retirement age. Under the national pension scheme, the age threshold for the increase is 65 years.

Disability pension

The earnings-related disability pension may be granted to persons who have an illness which reduces their ability to work. Besides health, the person’s possibilities of earning a living (by such available work which the person can reasonably be expected to manage considering their education and training, age, previous activities, living conditions and other comparable factors) are considered. In the public sector it suffices that, due to an illness, a handicap or an injury, the person has become incapable of doing their own job. When assessing whether a 60-year-old person with a long work history is entitled to a disability pension, the occupational nature of the work inability is emphasized especially.

A pension provider may grant a disability pension to an insured person who has turned 17 but who has not reached their retirement age (determined based on the birth year) . When the person reaches their retirement age, the disability pension will turn into an old-age pension. In the national pension scheme, the disability pension may be granted to an insured person who is between 16 and 64 years old.

In the earnings-related pension scheme, it is further required that the work inability can be estimated to last for at least one year. In the national pension scheme, the pension is not awarded to persons aged 16–19 until their possibilities of rehabilitation have been investigated. In the national pension scheme, a permanently blind person and a person permanently without mobile activity is always considered incapable of work.

The disability pension may be awarded either until further notice or as a fixed-term cash rehabilitation benefit. The cash rehabilitation benefit is granted if it can be expected that the person’s ability to work can be restored at least in part through treatment or rehabilitation. The granting of a cash rehabilitation benefit always requires a treatment or rehabilitation plan.

The earnings-related disability pension may be awarded as a full pension or a partial pension. A person is granted a full disability pension if their ability to work is considered to have been reduced by at least 3/5 and a partial disability pension if their ability to work is considered to have been reduced by 2/5 – 3/5. The partial disability pension is half of the full disability pension. A disability pension paid under the national pension scheme is not granted as a partial pension.

In the earnings-related pension scheme, the disability pension can also be granted as a years-of-service pension if the pension applicant has done work that requires great mental or physical effort for at least 38 years. In addition, the applicant’s ability to work must be reduced, but less so than for the actual disability pension. The first years-of-service pensions were paid out in 2018.

Part-time pension

Part-time pensions were granted within the earnings-related pension scheme in 1987–2016 to workers who changed from full-time to part-time work.

Survivors’ pension

After the death of the insured, the survivors’ pension may be paid to the children (orphan’s pension), the surviving spouse or a former spouse of the deceased (surviving spouse’s pension).

A child is entitled to the orphan’s pension if the child is under the age of 18 at the time of the death of the parent. In the national pension scheme, a child aged 18–20 is also entitled to an orphan’s pension if they are a full-time student or participates in vocational training (student’s pension). Children entitled to the orphan’s pension may be the deceased person’s own child, the surviving spouse’s child, the child of the surviving party to a registered relationship or an adopted child.

The surviving spouse’s pension may be granted to the surviving spouse if the spouses were married before the deceased reached the age of 65 and if the surviving spouse has or has had a child together with the deceased. If the spouses do not have a child together, the requirement is that the spouses were married before the surviving spouse reached the age of 50, the marriage had lasted for at least 5 years and that the surviving spouse had reached the age of 50 at the time of the death of the spouse. In the earnings-related pension scheme, the surviving spouse’s pension may also be granted to a surviving spouse aged less than 50, if the surviving spouse had received a disability pension continuously for at least three years before the death of the spouse. The above criteria also apply to the surviving party of a registered partnership.

In the earnings-related pension scheme, the survivors’ pension may also be granted to the deceased person’s former spouse or the divorced party to a registered partnership if the deceased person was, at the time of death, liable to pay alimony to the former spouse.

Special pensions for farmers

Special pensions for farmers are the farm-closure pension and the farmers’ early retirement aid. Farm-closure pensions were awarded from 1974 to 1992 and farmers’ early retirement aids from 1995 to 2018.

The farm-closure pension is a lifelong pension. The basic amount of early retirement aid granted after 2007 is converted to an old-age pension at the age of 63, while the supplementary component is paid until the age of 65.

Special pensions for farmers are paid within the earnings-related pension scheme only in the private sector.

Guarantee pension

The guarantee pension can be granted to a person who receives pension (old-age or disability pension, farmers’ early retirement aid or special provisions pensions) that qualifies them to receive the guarantee pension. In addition, the person’s combined pension income may not exceed the income limit for the guarantee pension. All pensions, including survivors’ and farm closure pensions, paid in Finland and from abroad affect the amount of the guarantee pension.

The guarantee pension may be granted to immigrants who have turned 65 years or disabled immigrants who are at least 16 years old. However, an immigrant is not entitled to the guarantee pension simply based on blindness or immobility. Receiving the guarantee pension requires that the person has been resident in Finland for at least 3 years since the age of 16. The guarantee pension is not paid to a person who resides abroad permanently.