Taxation and Contributions

The final income level of a pension recipient is the income in hand after taxation and the deduction of social security contributions.

The earnings-related, national and guarantee pensions are taxable earnings. As a rule, in the taxation of earned income, the taxation of statutory pensions is more lenient that the taxation of wages of the same amount. This is due to the special tax deductions of pension income.

Collective occupational pensions arranged by the employer and lump-sum pensions are also taxed as earned income. They are taxed in the same way as statutory pension income.

Pension based on voluntary individual pension insurance is taxable capital income, as are the withdrawals of long-term savings. Contributions made to insurance policies and long-term savings accounts are deductible in income taxation.

Tax agreements regulate the taxation of pensions paid abroad from Finland and from abroad to Finland.

Statutory pensions are taxable earnings

Statutory pensions are taxed basically in the same way as other earnings. However, the following component are not taxed:

- the child increase of the national pension

- a pensioner’s basic-rate care allowance

- front veterans’ supplements, veterans’ supplements, and pensioners’ housing allowance.

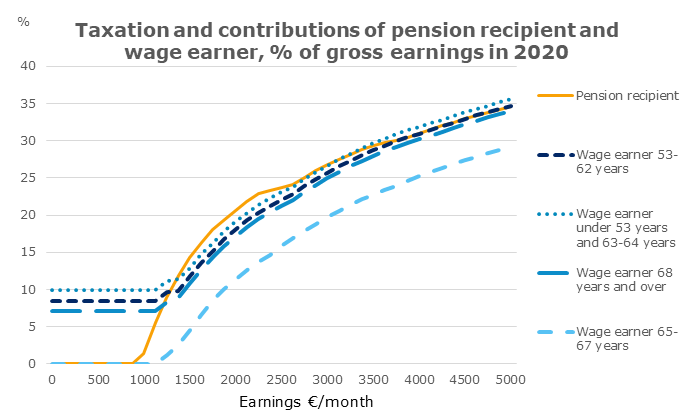

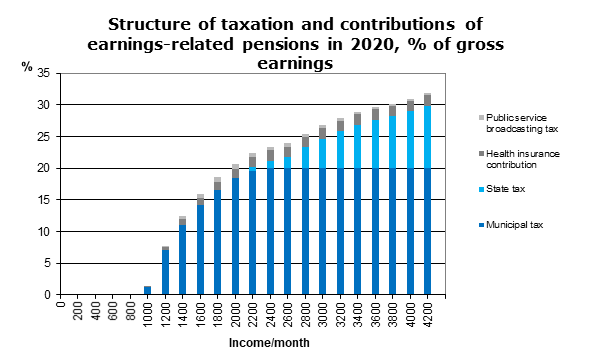

The taxation and contribution burden of pensions differ from those of wages due to different tax deductions and social insurance contributions. Pension income is subject to a pension income deduction in both municipal and state taxation.

No unemployment insurance or earnings-related pension contribution is deducted from the pension income. A government medical treatment charge is deducted from pension income, but not the medical care insurance contribution.

Table. Full amount of pension income deduction and the annual income level as of which the pension recipient starts to pay tax, as well as the annual income level as of which no deduction is granted (in 2020).

| Full deduction | Pension, tax becomes payable | Pension, no deduction | |

| Municipal taxation | 9,230 | 11,575 | 27,329 |

| State taxation | 11,540 | 24,656 | 41,909 |

Within the lower income brackets, the pensioner’s take-home income is higher than for wage earners at the same income level. Within the higher income brackets, the taxation evens out.

In the higher income brackets, the total contribution burden of pension income is more-or less on the same level with the wage-earner’s tax and contribution rate level, in which the wage-earner’s earnings-related pension and unemployment insurance contributions have been taken into account.

Employees’ earnings-related pension contributions

| Age of employee, years | Tax rat, % of gross wages |

| 17 – 52 | 7.15 |

| 53 – 62 | 8.65 |

| 63 – 67 | 7.15 |

The transition rules for the raised contribution for the 53-62-year-old is valid from 2017-2025.

The earnings from work of a pension recipient is taxed as any other earned income. Other earned income reduces the pension income deduction: when the deduction decreases, the tax rate increases. On the other hand, the earnings deduction and the deduction for the cost of acquiring an income is made to the actual wage income.

No unemployment insurance contribution is deducted from the wages of a person who has turned 65. The pension contribution is paid until the age when the insurance obligation ends, determined separately for each age cohort. No health insurance contribution is deducted from the wage of persons who have turned 68.

As of the beginning of 2005, after a brief transition period, voluntary individual pension has been taxed as capital rather than earned income.

Contributions to long-term savings accounts are deductible in the capital income taxation in the same way as are the contributions to voluntary pension insurance policies. The return for invested assets is not taxed during the savings period.

Payments paid by the service provider to the saver or other person entitled to the assets according to the savings contract when the person in question has reached the retirement age are considered capital income for the recipient. Taxable capital income is subject to a capital income tax of 30 per cent.

Contributions to a voluntary pension insurance or a long-term savings account can be deducted from the capital income to an annual amount 5,000 euros per year. If the employer has taken out such insurance for the taxpayer, the contributions for an insurance or long-term savings account taken out privately can be deducted to a maximum annual amount of 2,500 euros.

The retirement age entitling to tax deductions in individual pension insurance has been raised on several occasions (see table below). As of the beginning of 2013, the retirement age is 68 years for new insurance policies and long-terms savings accounts.

The retirement age at the time of taking out the insurance

| Insurance taken out | Age at which pension starts, years |

| – 30 Sept. 1992 | 55 |

| 1 Oct. 1992 – 23 June 1999 | 58 |

| 24 June 1999 – 5 May 2004 | 60 |

| 6 May 2004 – 17 Sept. 2009 | 62 |

| 18 Sept. 2009 – 31 Dec. 2012 | 63 (in most cases; the retirement age under the Employees Pensions Act) |

| 1 Jan. 2013 – | 68 |

Read more

More on other sites

As of 2006, the Finnish pensions of persons who live abroad permanently, that is, who have a limited tax-paying liability, are taxed in the same way as the pensions of persons who live in Finland. The tax rate, deductions and tax return procedure are the same as for persons who live in Finland.

Earlier, persons who lived abroad had to pay a tax at source of 35 per cent. All taxes of retirees who live abroad, including the calculated municipal tax according to the average municipal tax rate, go to the State.

In some cases, based on a tax treaty between Finland and the country in which the person lives, the pension is not taxed in Finland at all but only in the country in which the pensioner lives.

A pension from abroad has often been taxed in the country from which it is paid. In that case, no income tax is deducted in Finland, but the pension increases the tax rate on income from Finland. Pensions from certain countries are not taxed in the foreign country. In such cases, Finland taxes the pensions as pensions paid in Finland.

The tax treatment of the pension from a specific country is determined by the tax treaty between Finland and the country in question to prevent double taxation. Finland has concluded such treaties with more than 60 countries. Foreign pensions are often subject to the insured’s contribution for medical care insurance in Finland.

More on other sites