Projection Method

Description of projection model

Most of the projections are made using the long-term projection model of the Finnish Centre for Pensions (LTP model). The projections on pension expenditure cover both the earnings-related pension acts of the private and the public sectors, as well as the national and SOLITA pensions. Financing projections are only made for the private-sector earnings-related pension acts.

The Employees Pensions Act has been modelled as if it were managed by only one pension provider. This way we get results that apply on a system level. However, the LTP model does not deal with the position of the various pension providers in relation to each other.

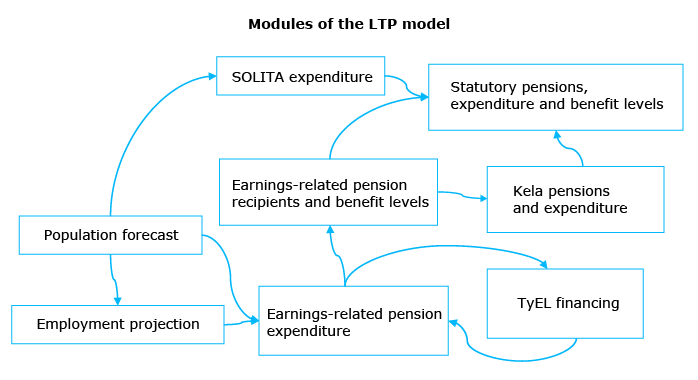

The LTP model consists of several interconnected modules, as presented in the figure below.

The population forecast determines the number of people of a pensionable age at different times. Together with the employment forecast it determines the size of the labour force. The employment forecast also plays a role in determining the size of future pensions as pension accrues from earned income. Together, the number of pensioners and the size of the pensions determine the pension expenditure.

The earnings-related pension expenditure is calculated separately for each pension act. Financing projections determine the contribution rate and the amount of assets under the Employees Pensions Act. The number of people receiving earnings-related pensions and the average pensions are calculated once all act-specific projections have been completed.

A semi-aggregated technique by age and gender is applied in the projections. For example, all working men aged 50 receive an equal wage. The method yields the same results regarding total pension expenditure as would a computationally more difficult individual-level technique. However, the semi-aggregated technique does not provide information on the size distribution of pensions. Such results can be obtained using the microsimulation model ELSI.

For the projection of national pensions, we use information on the current pension distribution as well as the projected distributions generated by the ELSI model. SOLITA pensions are determined based on the population forecast. The starting point for the projection is the current SOLITA expenditure, divided by age and gender.

The total statutory pension expenditure is calculated as the joint result of the different modules.