View the visualised money flows of earnings-related pensions

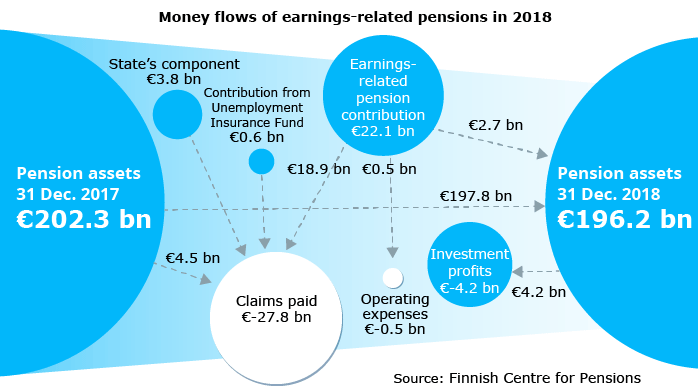

The pension assets of the earnings-related pension scheme decreased in 2018 by 6.1 billion euros, amounting to 196 billion euros at year-end. The last time the pension assets decreased was in 2011, as a result of the euro crisis. Examine the money flows with the visualisation of the earnings-related pension money flows.

The earnings-related pension expenditure exceeded the contribution income again in 2018. A total of 26.5 billion euros were collected in contributions, while the expenditure amounted to 28.3 billion euros. The return on investments (ROI) was 4.2 billion euros in the red.

As a result, the earnings-resulted pension assets were reduced by 6.1 billion and amounted to 196 billion euros at year-end.

The last quarter in 2018 was particularly challenging for investments. The valuation of listed shares in particular decreased heavily and resulted in a negative ROI. The last time this happened was in 2011 at the time of the euro crisis.

“The favourable wage sum development increased the premium income by 0.8 billion euros compared to 2017. The challenges relating to investments revealed the significance of investment risks. However, the solvency of the pension providers remained at a good level,” explains Jaakko Aho, Actuarial Manager at the Finnish Centre for Pensions.

The premium income of the private sector amounted to 16.9 billion euros and the expenditure to 18.0 billion euros. The investment returns were 2.0 billion euros in the red. The public sector premium income and State contributions amounted to 9.5 billion euros, while the expenditure was 10.3 billion euros. The public sector investment returns were 2.2 billion in the red.

Examine the visualised money flows

This visualisation of the earnings-related pension money flows by the Finnish Centre for Pensions illustrates the assets of the earnings-related pension system and their flows.

To examine the earnings-related pension money flows, select the desired year. You can limit the visualisation per earnings-related pension act. Place your cursor on the different circles to find out more about that part of the money flow.

Read more

Money flows connected to earnings-related pensions

Pension or investment assets?

When talking about the earnings-related pension assets, both ‘pension assets’ and ‘investment assets’ are used. Their difference lies in other receivables, debts and material goods which are included in the pension assets and reported on the balance sheet but excluded from the investment assets.

More information:

Eeva Puuperä, PAYG Adviser, eeva.puupera(at)etk.fi, phone +358 29 411 2525

Jaakko Aho, Actuarial Manager, jaakko.aho(at)etk.fi, phone +358 29 411 2306