Low birth rates complicate future pension financing

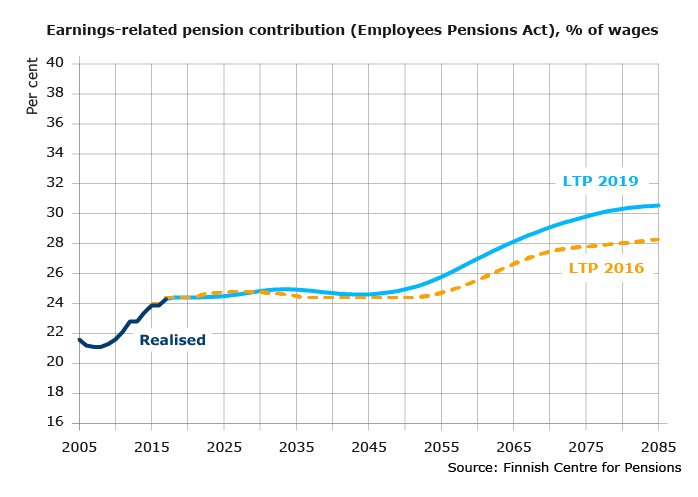

The pension financing outlook is stable for the next few decades. The insurance contribution under the Employees Pensions Act (TyEL contribution) can be kept below 25 per cent of the wages until the 2050s. However, in the long run, the low birth rates will cause a pronounced pressure to raise the contribution rate. The required preparations should be made ahead of time.

The Finnish Centre for Pensions has updated its long-term projections on the development of statutory pensions.

The projections follow Statistics Finland’s population forecast from 2018. According to that forecast, the working-age population in Finland will decline throughout the projection period (2019-2085) due to low birth rates. At the same time, the share of the population aged 65 or older will continue to rise.

Despite the weakening dependency ratio, the private sector TyEL contribution can be kept below 25 per cent up to the 2050s. After that, pension expenditure relative to wages will start to grow fiercely, generating a pressure to raise the contribution by several percentage points. With the projected demographic development, the contribution will rise to more than 30 per cent towards the end of the projection period.

“The pension financing outlook is rather stable for the next few decades. The low birth rates should be taken seriously, though. Now is the time to think about how to influence the demographic development,” states development manager Heikki Tikanmäki of the Finnish Centre for Pensions.

There is no pressure to raise the contribution rate in the overall earnings-related pension scheme. In the public sector, pension expenditure relative to earnings will decline at mid-century as, among other things, the contribution burden caused by past higher pension benefits will lessen. Currently, the contribution income of the earnings-related pension system is slightly under 30 per cent relative to earnings. That is enough to finance earnings-related pensions also in the future.

Uncertain economic fluctuations

The expected investment returns for the next few years are rather weak. In the next decade, the assumption of the real return on pensions is 2.5 per cent per year. After that it will rise to 3.5 per cent.

Despite the low investment returns, the pressure to raise the TyEL contribution in the near future is not significant in the baseline projection.

The general economic fluctuation is reflected in the optimistic and pessimistic scenarios. Due to the employment rate, the growth in earnings as well as the development of investment returns, the earnings-related pension insurance contribution will vary from 23 to 27 per cent in the 2020s in these scenarios.

“The contribution level in the next two decades depends on the economic development,” Tikanmäki explains.

Purchasing power of pensions will rise, ratio to earnings fall

In 2017, the average monthly pension of people living in Finland was 1,656 euros. According to the long-term projection, the purchasing power of pensions will continue to grow. For example, in 2030, the average monthly pension is expected to be around 1,850 euros. The individual-level pension variation is not increasing.

For a long time, pensions in payment have been at a 50-per-cent level relative to the average earnings. After 2030, the ratio will drop below 50 per cent. In 2045, the average pensions are estimated at 46 per cent of the average earnings. In 2017, the ratio was 53 per cent.

The main reason for the declining ratio is the life expectancy coefficient, which adapts the benefit level to correspond to changes in life expectancy.

- Statutory Pensions: Long-term Projections 2019. Finnish Centre for Pensions

- Long-term projections (etk.fi)

More information:

Heikki Tikanmäki, Development Manager, phone +358 29 411 2374, heikki.tikanmaki(at)etk.fi

Mikko Kautto, Director, phone+358 29 411 2185, mikko.kautto(at)etk.fi

The report includes:

- optimistic and pessimistic economic scenarios,

- sensitivity analyses: mortality, birth rate, incidence rate of disability pensions, earnings growth, employment rate and return on pension assets

- projections on the development of pension distributions

- value of accrued pension rights and funding balance calculations of the earnings-related pension scheme (both closed and open group analyses), and

- an internal rate of return calculation, which shows how much the age cohorts and genders get in return for their pension contributions.

Photo: iStock