From Finland Abroad

The social security regulations of the EU consolidate the social security systems of the different Member States. The social security agreements are bilateral agreements between two countries.

The aim of the EU regulations on social security and the social security agreements is to make sure that a person is covered by the laws of only one country at a time

The social security agreements and EU’s regulation on social security determine which country’s laws are to be applied to a person who moves between two or several countries and what social security rights such a person has.

One of the aims of the regulations and the agreements is to ensure that the social security continues uninterruptedly for a person who moves from one country to another. Another aim is to prevent situations in which an employee would be insured for social security in two countries and pay double social security contributions. A third aim is to remove any obstacles for receiving social security benefits.

The level of social security and the benefits are always determined by national laws.

One of the central principles of the social security agreements and the EU social security regulations is that people be treated equally. That is why the citizens of the country with which a social security agreement has been signed are guaranteed the same rights and obligations as the country’s own citizens.

Main rule of insurance

The main rule in both the EU social security regulations and the social security agreements is that a person working abroad is covered by the social security laws of the country in which they work. The social security contributions are paid to that country and the right to social security benefits (such as pensions) is determined based on the laws of the country in which the person works.

Working abroad

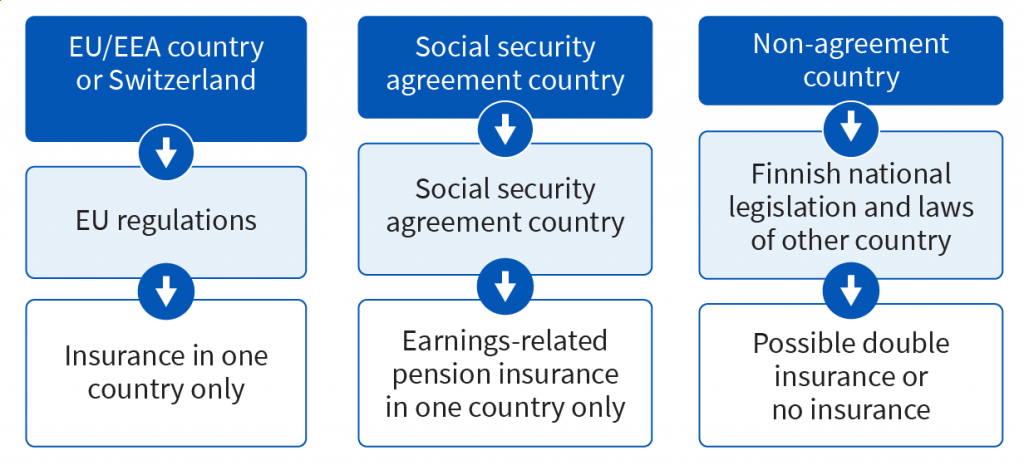

Social security while working abroad varies depending on whether the work is done in

- an EU Member State or an EEA country,

- a social security agreement country, or

- a non-agreement country.

Even if you are a Finnish citizen, have a Finnish employer or pay your taxes to Finland, you are not automatically covered by Finnish social security while working abroad.

If you are posted abroad on a temporary basis as an employee, a self-employed person or a grant recipient (equated with a self-employed person), you may be covered by Finnish social security while working abroad. If you are a telecommuter, you may also be compared to a self-employed person. The Finnish Centre for Pensions can grant an A1 certificate to attest that Finnish social security laws are applied to a person working in en EU/EEA country, Switzerland or a country with which Finland has a social security agreement.

For more information on government officials, seafarers and cabin crew, go to sections “Working in an EU country”, “Working in an agreement country” and “Working in a non-agreement country”.

If you work in several EU Member States or Switzerland at the same time, different rules will apply. For more information, see section “Working in an EU country” and “Working in several EU/EEA countries or Switzerland”.

Conditions for posting

Click the headings below for more information on the conditions of posting.

You are a posted employee if

- you have been posted abroad by a Finnish employer,

- you were subject to Finnish social security immediately before going abroad, or

- you work abroad temporarily.

You are considered a posted self-employed person if

- you, as a rule, engage in self-employment in Finland,

- you engage in similar type of self-employment abroad as in Finland, or

- you engaged in self-employment in Finland before going abroad (in practice, you have had a valid insurance under the Self-employed Persons’ Pensions Act for more than four months before going abroad).

If you receive a grant and are temporarily working abroad, you may be covered by Finnish social security if

- the grant was awarded from Finland,

- you were subject to Finnish social security legislation immediately before going abroad, or

- you have taken out insurance under the Farmers’ Pensions Act for the period that you work abroad.

If you are an employee or a self-employed person and you are telecommuting from abroad, you are covered by the social security of the country in which you actually telecommute. However, your employer can apply for an A1 certificate for coverage under Finnish social security legislation if your telecommuting abroad has been agreed on. If you are self-employed, you have to apply for the certificate yourself.

If you are a cross-border worker, you work or are self-employed in one EU country but live in another country. As a cross-border worker, you and your employer pay your social security contributions only to one country. If you live in Finland, you may qualify for some benefits paid by the Social Insurance Institution of Finland (Kela). Contact Kela for more information on the social security benefits of cross-border workers.

Most international organisations, including the UN and its specialised agencies, have their own pension systems. If you work for such an organisation, contact your employer for information on its own pension system. The EU employs, among others, officials, temporary staff, locally hired staff, special advisers and researchers. If you work for the EU, ask your employer about your pension and social security rights. If you work for the EC, you may be covered by EU’s own pension system.

Read more:

More on other sites: