Age at retirement continues to rise

The average age of retirement on an earnings-related pension in Finland edged up to 61.3 years in 2018, according to statistics from the Finnish Centre for Pensions. New retirees were one month older than the year before. Overall the number of new retirees on an old-age pension was considerably down from the previous year as new rules raising the age limit for old-age pension began to take effect.

The minimum retirement age for persons born in 1955 is 63 years 3 months. This drove down the number of persons retiring on an old-age pension in 2018 by more than 10 per cent. Although the number of persons retiring on a disability pension increased at the same time by more than 1,000, average age at retirement continued to rise.

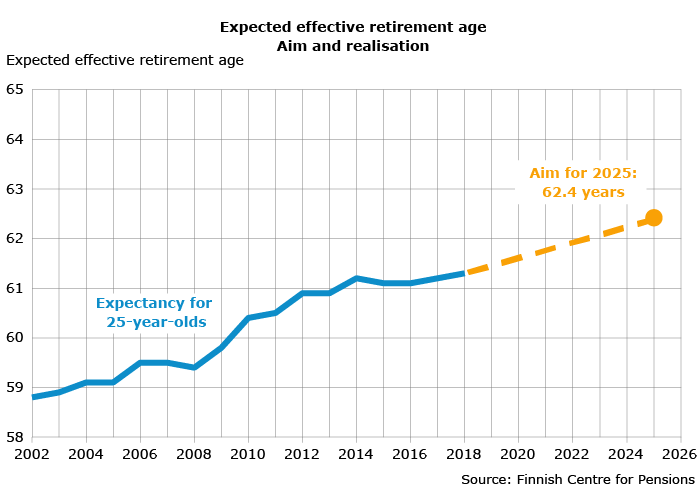

The average age at retirement has risen by 2.5 years since 2000. The aim is to go even higher so that by 2025, people in Finland would be retiring on an earnings-related pension, on average, at age 62.4 years. Reaching this target would require an annual increase of over one-tenth in the average retirement age.

“The higher age limit for old-age pension will considerably push up the age at retirement. But that alone is not enough to reach the target. We will also need to see a marked decrease in the number of persons retiring on a disability pension,” says Finnish Centre for Pensions development manager Jari Kannisto.

In 2018 the expected effective retirement age for a 25-year-old was 61.3 years and for a 50-year-old 63.1 years. The expected effective retirement age describes the average age at retirement if retirement and mortality rates remain unchanged at the level of the statistical year.

Increased numbers retiring on disability pension

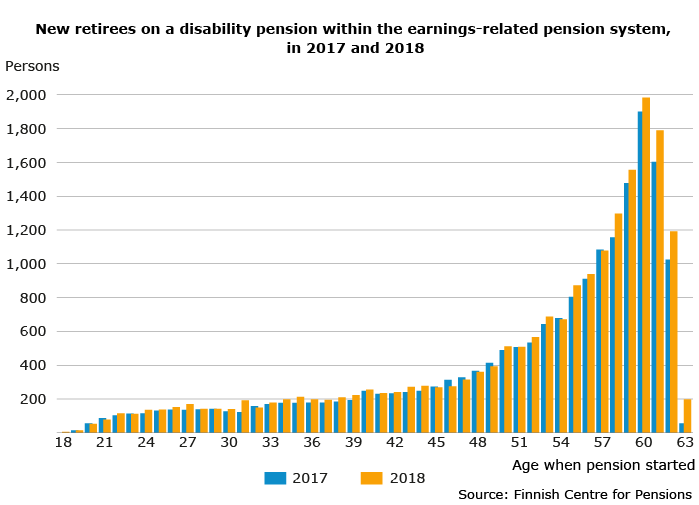

Almost 20,000 persons retired on a disability pension in 2018, an increase of 1,000 or 7% on the previous year.

One-quarter of this increase is attributable to persons under 50 and one-half to persons over 60 years. Persons aged over 60 can be granted a disability pension on less stringent criteria.

“A higher retirement age will mean there are those who can’t manage to retain their ability to work through to old-age retirement. In last year’s statistics this is reflected in an increased number of persons retiring on a disability pension at age 63,” Kannisto points out.

In 2018 a total of 69,000 persons retired on an earnings-related pension, of whom 49,000 or 70% retired on an old-age pension. The number of persons retiring on an old-age pension was down by 8,000 from 2017.

More information:

Jari Kannisto, Development Manager, phone +358 29 411 2232, jari.kannisto(at)etk.fi

Further material:

Effective retirement age in 2018, Jari Kannisto (SlideShare)

More statistical information on new retirees

Retirement on an earnings-related pension: three facts

- Expected effective retirement age in 2018 was 61.3 years.

- Around 69,000 persons retired on an earnings-related pension in 2018.

- More than 1.4 million people receive an earnings-related pension based on their own employment.

Note! Persons taking early payment of a partial old-age pension are not included in the figures for new retirees.

Expected effective retirement age

- Describes the average age of retirement on an earnings-related pension if retirement and mortality rates remain at the same level as in the statistical year.

- Is unaffected by the population age structure and is calculated on the same principle as life expectancy.

- Measures the development of age of retirement on an earnings-related pension for 25-year-olds and 50-year-olds.

Rising age of retirement on old-age pension

Under the 2017 pension reform the age limit for old-age retirement will be raised annually by three months through to 2027, when the lowest old-age retirement age will be 65 years. The age limit will subsequently be linked to the development of average life expectancy.

In order to achieve the target at a steady pace, the effective retirement age needs to rise annually by 0.16 years.

The discontinuation of the unemployment pension and the falling number of disability pensions have contributed the most to the rise in effective retirement age. In the future the higher age threshold for old-age retirement will have the same effect of postponing retirement.