Money Flows

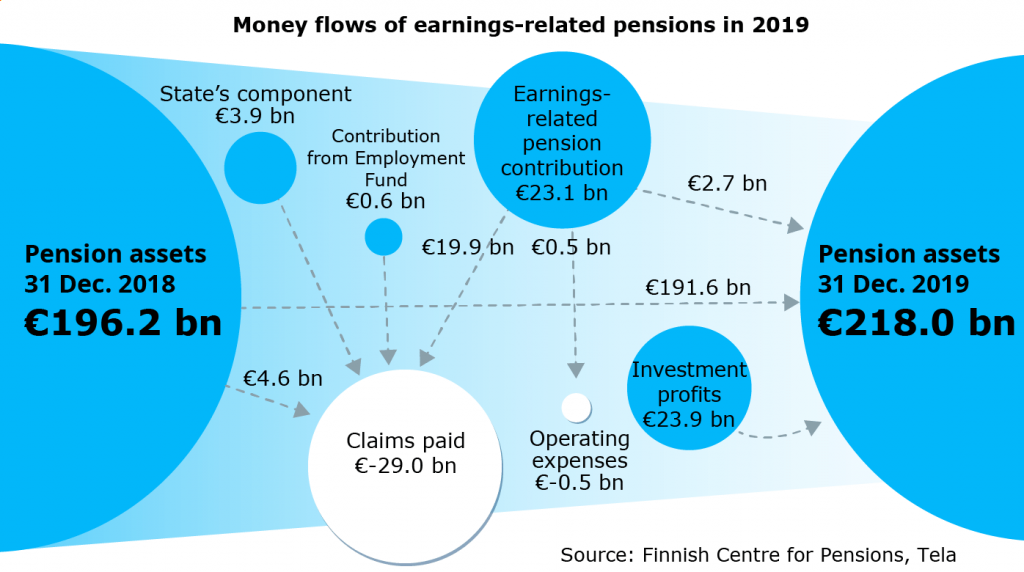

In addition to pension contributions charged from employers, employees and the self-employed, earnings-related pensions are also financed through payments into the earnings-related pension scheme from unemployment insurance contributions, state shares and earnings-related pension assets as well as investment profits from said assets.

Employers disburse pension contributions based on the earnings of their employees to their own pension providers, who use them to finance earnings-related pensions currently on their responsibility and, on the other hand, prepare for the payment of future pensions by funding payments. The self-employed and farming entrepreneurs pay their own pension contributions directly to the pension provider.

The Employment Fund compensates the pension providers for costs arising from employees’ unemployment and training allowances and pension accrual based on alternation leave. All pension providers participate in the costs arising from accrued pension shares from unsalaried periods of allowance. Additionally, the State reimburses the pension providers for benefits paid during periods of study and periods of child-care.

The pension assets of the earnings-related pension system increased by 21.8 billion in 2019, standing at 218.0 billion euros at the end of the year. Due to the good investment markets, the return on investments was 23.9 billion euros. Pensions to the amount of 29.0 billion euros were paid out while the collected pension contributions were 23.1 billion euros.

The pension assets include all assets meant to cover the earnings-related pension insurance obligations. Most of the pension assets are in the form of investment capital, which amounted to 216.3 billion euros at year-end.

The visualisation of the earnings-related pension money flows illustrates the assets of the earnings-related pension system and their flows in given years.

The user can select the desired year and examine how the earnings-related assets flowed in that year. Click the link below to access the visualisation.

Link to access the visualisation

In addition to paying earnings-related pensions, pension contributions collected are funded and used to pay the maintenance and business costs of the pension providers. Such costs include, for example, costs arising from pension provider operations such as wages, commissions and additional personnel expenses. Costs arising from the investment operations of a pension provider are not included in the operating costs.

Earnings-related pension providers have mainly invested their pension assets in shares, bonds and real estate, both domestic and foreign. More detailed information on the investment operations of statutory pension assets is available on, for example, the website of the Finnish Pension Alliance TELA.

Read more

Further information