Earnings-related Pension Indexes

When determining a starting earnings-related pension, the earnings and income from work of the insured are adjusted with the wage coefficient to the level of the first year of retirement.

All earnings-related pensions in payment are adjusted annually, at the beginning of January, with the earnings-related pension index.

Earnings-related pension index

The index adjustment amount is affected by the changes in the consumer price and income level index calculated by Statistics Finland. In the earnings-related pension index, the share of change in price level is 80 per cent and the share of wage-earners’ income level is 20 percent.

A simplified example:

If the change in income level is 3.5 per cent and the change in consumer price level is 2 per cent:

- Change in earnings-related pension index = 0.8 x 2 + 0.2 x 3.5 = 2.3%

- Change in wage coefficient = 0.2 x 2 + 0.8 x 3.5 = 3.2%

In practice, this means that the adjustment according to the earnings-related pension index compensates the change in price level and also improves the purchasing power of the pension with an amount that is 20 per cent of the increase of the index of wage and salary earnings that exceeds the consumer price index increase, that is, of the relative change of the wage-earners’ real income level.

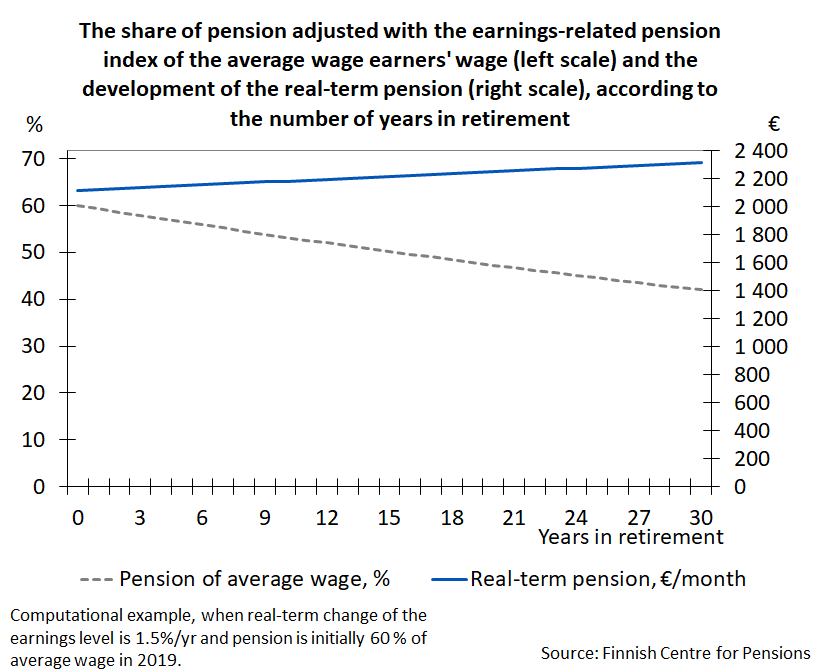

The increase in the purchasing power of the pension is thus higher the more vivid the real increase of the income level is. At the same time, pensions adjusted with the earnings-related pension index will lag behind the average income level development, the more so the faster the real income level develops.

The wage coefficient is an index of the active employment period

In the wage coefficient, the share of change in price level is 20 per cent and the share of a change in the wage-earners’ income level is 80 per cent. In addition to the change in price level, the wage coefficient thus compensates 80 per cent of the real change in wage-earners’ income level.

In addition to the adjustment of wages and earned income, certain monetary amounts relate to the development of the wage coefficient. the amounts are prescribed in the earnings-related pension acts. They are used to determine, for example, who is subject to the insurance obligation or to the pension acts, as well as who qualify for certain benefits.

Indexes based on realised price and earnings development

The pension indexes are always based on an already realised development of the price and earnings level as the index calculation is made using the figures of the third quarter (Q3) of the year before the year in which the adjustment is made. For example, the pension indexes for 2023 pension are based on changes in price and earnings level from Q3 in 2021 to Q3 in 2022.

As of the beginning of 2017, the point figures of the earnings-related pension index and the wage coefficient are no longer affected by changes in the employees’ earnings-related pension contribution.

The Ministry of Social Affairs and Health issues a statute of the index point figures of the earnings-related pension index and the wage coefficient by the end of October each year, that is, two months before the pensions are adjusted at the turn of the year.

The earnings-related pension index and the wage coefficient are enacted in the Employees Pensions Act (Sections 96-100).

How is an index adjustment done?

Example: adjustment of earnings-related pension in payment

The retiree got a monthly earnings-related pension of 1,400 euros when the pension began in 2017. The table contains the calculation formulas for determining the pension in 2018–2020. The index adjustment is made to the amount of pension in payment in the previous year.

| Year | Earnings-related pension index | Index-adjusted pension |

|---|---|---|

| 2017 | 2534 | 1,400.00 |

| 2018 | 2548 | 2548 / 2534 x 1,400 = 1,407.73 |

| 2019 | 2585 | 2585 / 2548 x 1,407.73 =1,428.18 |

| 2020 | 2617 | 2617 / 2585 x 1,428.18 = 1,445.86 |

Example: adjustment of earnings

In the example, the annual earnings of an employee have been adjusted to the 2020 level, the beginning year of the pension. The index adjustment is made directly from the level of the year in which the wage is earned to the level of the year in which the pension will begin.

| Year | Wage coefficient | Wage, €/year | Index-adjusted wage, € |

|---|---|---|---|

| 2016 | 1,373 | 25,000 | 1,446 / 1,373 x 25,000 = 26,329.21 |

| 2017 | 1,389 | 26,350 | 1,446 / 1,389 x 26,350 = 27,431.32 |

| 2018 | 1,391 | 26,890 | 1,446 / 1,391 x 26 890 = 27,953.23 |

| 2019 | 1,417 | 27,500 | 1,446 / 1,417 x 27 500 = 28,062.81 |

| 2020 | 1,446 | 28,760 | 1,446 / 1,446 x 28,760 = 28,760.00 |