Solidity of Pension Providers

Under all circumstances, pension providers have to pay out and fund the pensions that they are responsible for. Pension providers prepare for the risks relating to insurance operations and investments with the solvency margin.

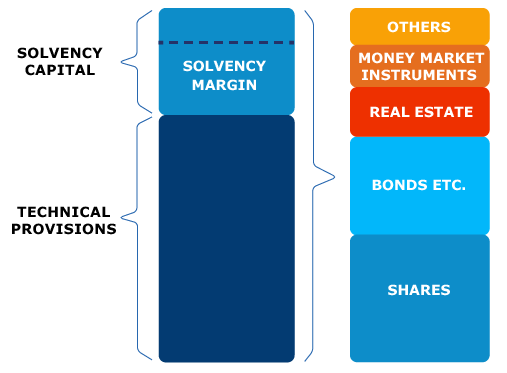

Each pension provider must have enough assets to cover its future pension liabilities. The estimate of each pension provider’s technical provision is stated in its financial statements. In addition, pension providers must have a sufficient solvency capital to cover the risks relating to its insurance and investment operations.

Pension assets must be invested productively and protectively. Investments must be diversified so that they are secure, profitable and diverse and can easily be liquidated. The regulations on calculating the solvency margin and covering technical provisions steer the diversification of investments in more detail.

To calculate the solvency, the pension providers must be able to identify the risks involved in each investment. Each investment may include several risks, which are categorised in the solvency regulations. The risk categories relate to:

- shares,

- interest rates,

- credit margins,

- real estate,

- currencies,

- commodities,

- return requirements,

- insurance,

- balance, and

- other risks.

The computations result in a the solvency limit. It must cover the risks that may be realised in the next year to approximately 97 per cent.

The rules on the solvency margin are common for all pension providers, but the operating principles derived from the solvency limit differ somewhat based on the type of pension provider. These principles are defined in the Pension Insurance Company Act, the Company Pension Funds Act and the Insurance Funds Act.

The Financial Supervisory Authority supervises the solvency and coverage of the technical provision of Finnish pension providers.

The solvency regulations were reformed as of the beginning of 2017.